It’s hard to believe but June is already here, which means summer is right around the corner. While temperatures outside are heating up, the discount brokerage deals and promotions section is gradually warming back up.

Heading into the new month there was a good mix of extensions as well as a new offer from National Bank Direct Brokerage in May that is sure to add some sizzle to the summer shopping season.

Starting first with extensions, two big deals players, BMO InvestorLine and Desjardins Online Brokerage, gave the go ahead for their existing offers to continue (more details below). This is a healthy sign as both of these firms are long time proponents of deals and promotions.

The big news, however, is the offer that crossed our radar from National Bank Direct Brokerage. This offer has a relatively low threshold to qualify ($5,000) and offers 25 commission-free trades which are good for up to one year. If it sounds familiar, it’s because another bank-owned online brokerage, RBC Direct Investing, also has an offer that is currently running to mid-June that offers 20 commission-free trades for a deposit of $5,000. So, in this case, the commission-free trade promotion bid has been raised by NBDB.

Another interesting feature of the offer from National Bank Direct Brokerage is that once the trades are used up (within the first year only), the standard commission charge per trade is only $6.95 which means that there is a trading discount as well as free trades.

With one offer set to expire mid-month (from RBC Direct Investing), it will be interesting to see if it too will get an extension or if there will be another provider currently on the sidelines jump in to the deals and promotions mix to be ready for the building interest in the marijuana legalization ‘buzz’ that is building.

We’ll keep a look out for new offers and if there are any that might be of interest to DIY investors, feel free to let us know in the comments below.

Expired Deals

No expired deals to report at the outset of the month.

Extended Deals

There were two offers that were scheduled to expire at the end of May that have been renewed:

First, Desjardins Online Brokerage has extended their commission credit offer through to the end of September.

Also, BMO InvestorLine extended their combined commission-free trade and cash back offer through to the end of June.

New Deals

While there were no new deals announced on June 1st, there was a new deal from National Bank Direct Brokerage that did cross the wire late in May. While this deal may technically have been in rotation at the end of April, it is not advertised in the special offers section of the NBDB website; we discovered this add running in rotation on social media and verified that it is active (at the time of publication).

Discount Brokerage Deals

- Cash Back/Free Trade/Product Offer Promotions

- Referral Promotions

- Transfer Fee Promotions

- Contests & Other Offers

- Digital Advice + Roboadvisor Promotions

Cash Back/Free Trade/Product Offer Promotions

| Company | Brief Description | Minimum Deposit Amount | Commission/Cash Offer/Promotion Type | Time Limit to Use Commission/Cash Offer | Details Link | Deadline |

|---|---|---|---|---|---|---|

| A Sparx Trading exclusive offer! Use the promo code “Sparx Trading” when signing up for a new account with Jitneytrade and receive access to their preferred pricing package. | n/a | Discounted Commission Rates | none | For more details click here | none | |

|

Open and fund a new account (TFSA, Margin or RRSP) with at least $1,000 and you may be eligible to receive $88 in commission credits (up to 17 commission-free trades). Use promo code SPARX88 when signing up. Be sure to read terms and conditions carefully. | $1,000 | $88 commission credit | 60 days | Access this offer by clicking here: $88 commission-credit offer . For full terms and conditions, click here. | none |

|

Open and fund a new account (TFSA, Margin or RRSP) with at least $1,000 and you may be eligible to receive 5 commission-free trades. Use promo code 5FREETRADES when signing up. Be sure to read terms and conditions carefully. | $1,000 | 5 commission-free trades | 60 days | 5 commission-free trade offer | December 31, 2018 |

|

Open a new account at National Bank Direct Brokerage with at least 5,000 and you may be eligible to receive up to 25 commission-free trades, good for up to one year. There is also a promotional discounted commission-pricing available within the first year to individuals who use up their 25 trades; trading commissions for the first year are $6.95. Use promo code SPRING 2018 when signing up to be eligible for this offer. This offer is also available to existing clients. Be sure to read terms and conditions for full details. | $5,000 | 25 commission-free trades + $6.95 commission per trade pricing | 365 days | National Bank Spring Offer | July 6, 2018 |

| Open and fund a new account at RBC Direct Investing with at least $5,000 in net new assets and you may be eligible to receive up to 20 commission-free equity trades which are good for up to one year. Be sure to read terms and conditions for full details. | $5,000 | 20 commission-free trades | 365 days | RBC Direct Investing Commission-free Trades Promotion | June 14, 2018 | |

| Desjardins Online Brokerage is offering new clients 1% of assets transferred into the new account in the form of commission credits (to a maximum value of $1,000). Minimum qualifying deposit is $10,000. To qualify, individuals will have to call 1-866-873-7103 and mention promo code DisnatTransfer or email: [email protected]. See details link for more info. | $10,000 | 1% of assets transferred in the form of commission-credits (max credits: $1,000) | 6 months | Disnat 1% Commission Credit Promo | September 30, 2018 | |

|

Open and fund a new qualifying account with at least $25,000 and you may qualify for one month of unlimited commission-free trades and up to one month free of an advanced data package. Use promo code ADVANTAGE14 when opening a new account. Be sure to read terms and conditions for full details. | $25,000 | commission-free trades for 1 month + 1 month of advanced data. | 1 month | Active Trader Program | December 31, 2018 |

| Open a new qualifying account with BMO InvestorLine or fund a qualifying existing account, with at least A) $50,000; B) $100,000 or C) $300,000+ in net new assets and you may be eligible to receive up to 20 commission-free equity trades plus A) $50 cash back; B) $150 cash back or C) $500 cash back. Commission-free trades are good for up to two months. In addition, eligible individuals can receive an extra $50 as part of the refer a friend program. Use promo code SPRING when signing up. Be sure to read the terms and conditions for more details on the offer. | A) $50,000 B) $100,000 C) $300,000 | 20 commission-free equity trades AND A) $50; B) $150 C) $500. | Commission-free equity trades are good for up to two months. Cash back will be deposited the week of January 21, 2019. | BMO InvestorLine Spring 2018 Campaign | June 30, 2018 | |

Expired Offers |

||||||

| Last Updated: June 01, 2018 18:55 PT |

Referral Promotions

| Company | Brief Description | Minimum Deposit Amount | Incentive Structure | Time Limit to Use Commission/Cash Offer Deposit | Details Link | Deadline |

|---|---|---|---|---|---|---|

|

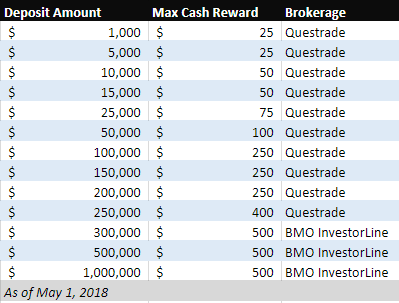

Refer a friend to Questrade and when they open an account you receive $25 cash back and they receive either A) $25; B) $50; C) $75; D) $100; or E) $250 depending on the amount deposited amount. Enter code: 476104302388759 during account sign up to qualify. Be sure to read the terms and conditions for eligibility and additional bonus payment structure and minimum balance requirements. | A) $1,000 B) $10,000 C) $25,000 D) $50,000 E) $100,000+ | $25 cash back (for referrer per referral; $50 bonus cash back for every 3rd referral) For referred individuals: A) $25 cash back B) $50 cash back C) $75 cash back D) $100 cash back E) $250 cash back | Cash deposited into Questrade billing account within 7 days after funding period ends (90 days) | Refer a friend terms and conditions Code Number: 476104302388759 | none |

| If you refer a friend/family member who is not already a Scotia iTRADE account holder to them, both you and your friend get a bonus of either cash or free trades. You have to use the referral form to pass along your info as well as your friend/family members’ contact info in order to qualify. There are lots of details/conditions to this deal so be sure to read the details link. | A) $10,000 B) $50,000+ | A) You(referrer): $50 or 10 free trades; Your “Friend”: $50 or 10 free trades (max total value:$99.90) B) You(referrer): $100 cash or 50 free trades; Your “Friend”: $100 cash or 50 free trades (max total value: $499.50) | 60 days | Refer A Friend to Scotia iTrade | tbd | |

| If you (an existing BMO InvestorLine client) refer a new client to BMO InvestorLine and they open an account with at least $50,000 the referrer and the referee may both be eligible to receive $50 cash. To qualify the referee must use the email of the referrer that is linked to their BMO InvestorLine account. See terms and conditions for full details. | $50,000 | You(referrer): $50; Your Friend(referee): $50 | Payout occurs 45 days after minimum 90 day holding period(subject to conditions). | BMO InvestorLine Refer-a-Friend | October 31, 2018 | |

Expired Offers |

||||||

| Last Updated: June 1, 2018 18:55 PT |

Transfer Fee Promotions

| Company | Brief Description | Maximum Transfer Fee Coverage Amount | Minimum Deposit Amount for Transfer Fee Eligibility | Details Link | Deadline |

|---|---|---|---|---|---|

|

Transfer $15,000 or more to Qtrade Investor from another brokerage and Qtrade Investor may cover up to $150 in transfer fees. See terms and conditions for more details. | $150 | $15,000 | Transfer Fee Rebate | none |

| Transfer $15,000 or more to RBC Direct Investing and they will pay up to $135 in transfer fees. | $135 | $15,000 | Transfer Fee Rebate Details | none | |

|

Transfer $20,000 or more to a National Bank Direct Brokerage account and they will pay up to $135 plus taxes in transfer fees. | $135 | $20,000 | Transfer Fee Rebate | none |

|

Transfer $25,000 or more from another brokerage and Credential Direct will cover up to $150 in transfer fees. Use promo code SWITCHME when signing up to qualify for the transfer promotion. | $150 | $25,000 | Credential Direct Transfer Fee Rebate | none |

|

Move your brokerage account to Questrade and they’ll cover the transfer-out fee up to $150. | $150 | $25,000 | Transfer Fee Promo | none |

| Transfer at least $25,000 or more in new assets to TD Direct Investing when opening a new account and you may qualify to have transfer fees reimbursed up to $150. Be sure to contact TD Direct Investing for further details. | $150 | $25,000 | Contact client service for more information (1-800-465-5463). | none | |

| Transfer $25,000 or more into a CIBC Investor’s Edge account and they will reimburse up to $135 in brokerage transfer fees. Clients must call customer service to request rebate after transfer made. | $135 | $25,000 | Confirmed with reps. Contact client service for more information (1-800-567-3343). | none | |

| Disnat is offering up to $150 to cover the cost of transfer fees from another institution. To be eligible, new/existing clients need to deposit $50,000 into a Disnat account. You’ll have to call 1-866-873-7103 and mention promo code DisnatTransfer. See details link for more info. | $150 | $50,000 | Disnat 1% Commission Credit Promo | September 30, 2018 | |

| Open a new qualifying account with BMO InvestorLine or fund a qualifying existing account, by transferring in at least $200,000+ in net new assets and you may be eligible to have transfer fees covered up to $200. Use promo code SPRING when signing up. Be sure to read the terms and conditions for more details on the offer. | $200 | $200,000 | BMO InvestorLine Spring 2018 Campaign | May 31, 2018 | |

Expired Offers |

|||||

| Last Updated: June 1, 18:55 PT |

Other Promotions

| Company | Brief Description | Minimum Deposit Amount Required | Details Link | Deadline |

|---|---|---|---|---|

| Desjardins Online Brokerage, in conjunction with MoneyTalks, is offering 3 months of the “Inside Edge” investor information service to Desjardins Online Brokerage clients. Use promo code DESJ2016 during checkout to qualify. Be sure to read full terms and conditions for more information. | n/a | MoneyTalks Inside Edge Discount | none | |

| Desjardins Online Brokerage is offering $50 in commission credits for new Disnat Classic clients depositing at least $1,000. See terms and conditions for full details. | $1,000 | Broker@ge 18-30 Promotion | none | |

| Scotiabank StartRight customers can receive 10 commission-free trades when investing $1,000 or more in a new Scotia iTrade account. Trades are good for use for up to 1 year from the date the account is funded. Use promo code SRPE15 when applying (in English) or SRPF15 when applying in French. Be sure to read full terms and conditions for full details. | $1,000 | StartRight Free Trade offer | none | |

Expired Offers |

||||

| Last Updated: June 1, 2018 18:55 PT |

Digital Advice + Roboadvisor Promotions

| Robo-advisor / Digital advisor | Offer Type | Offer Description | Min. Deposit | Reward / Promotion | Promo Code | Expiry Date | Link |

|---|---|---|---|---|---|---|---|

|

Discounted Management | Open and fund a new Questrade Portfolio IQ account with a deposit of at least $1,000 and the first month of management will be free. For more information on Portfolio IQ, click the product link. | $1000 | 1st month no management fees | KDKFNBBC | None | Questrade Portfolio IQ Promo Offer |

|

Discounted Management | Open a new account with BMO SmartFolio and receive one year of management of up to $15,000 free. See offer terms and conditions for more details. | $1,000 | 1 year no management fees | STSF | April 1, 2018 | SmartFolio New Account Promotion |

|

Cash Back – Referral | BMO SmartFolio clients will receive $50 cash back for every friend or family member who opens and funds a new SmartFolio account. Friends and family referred to SmartFolio will receive $50 cash back for opening and funding an account, plus automatic enrollment into SmartFolio’s mass offer in market at the time. See offer terms and conditions for more details. | $1,000 | $50 cash back (referrer) $50 cash back (referee) | Unique link generated from SmartFolio required. | None | SmartFolio Website |

|

Transfer Fee Coverage | Transfer at least $25,000 into Virtual Wealth when opening a new account and you may be eligible to have up to $150 in transfer fees covered by Virtual Wealth. | $25,000 | up to $150 in transfer fees covered | None | None | Contact customer service directly for more information. |

| Last Updated: June 1, 2018 18:55 PT |

Though this was a short week because of the holidays, there was still a healthy dose of news to digest and trade around. For Canadian online brokerages, the race is on not only to report some of the big news but to put a creative spin on it.

Though this was a short week because of the holidays, there was still a healthy dose of news to digest and trade around. For Canadian online brokerages, the race is on not only to report some of the big news but to put a creative spin on it.

Despite having captured the imagination of the internet and having squandered so many people’s valuable time there’s a lesson in here for online brokerages, which is to get attention online, you have to be interesting.

Despite having captured the imagination of the internet and having squandered so many people’s valuable time there’s a lesson in here for online brokerages, which is to get attention online, you have to be interesting.

Eventually spring was bound to show up. And, like the green shoots, flowers and sunshine, it’s a time for change and opportunity. Fortuitously, Canadian discount brokerages are also taking their cues from spring and rolling out some interesting new items for the season.

Eventually spring was bound to show up. And, like the green shoots, flowers and sunshine, it’s a time for change and opportunity. Fortuitously, Canadian discount brokerages are also taking their cues from spring and rolling out some interesting new items for the season.

The old trading adage of sell in May and go away clearly did not apply to this week’s market activity. It’s still early enough in the month that anything can happen, however. With the announcement of the end of decades of hostilities between North and South Korea, it’s as good as any segue into the action taking place in the Canadian discount brokerage space.

The old trading adage of sell in May and go away clearly did not apply to this week’s market activity. It’s still early enough in the month that anything can happen, however. With the announcement of the end of decades of hostilities between North and South Korea, it’s as good as any segue into the action taking place in the Canadian discount brokerage space.

For traders of Canadian securities listed on the TSX/TSX-V and Montreal Exchange, the weekend showed up a little earlier than anyone expected. With trading on these markets halted, it was an opportune time for the Toronto crowd to tune into the wizardry of the Toronto Raptors. Of course, online brokerages in Canada are used to throwing a few surprises at the DIY investing space and this week, some pleasant surprises came to market that spell interesting times for active traders.

For traders of Canadian securities listed on the TSX/TSX-V and Montreal Exchange, the weekend showed up a little earlier than anyone expected. With trading on these markets halted, it was an opportune time for the Toronto crowd to tune into the wizardry of the Toronto Raptors. Of course, online brokerages in Canada are used to throwing a few surprises at the DIY investing space and this week, some pleasant surprises came to market that spell interesting times for active traders. For many sports fans, playoffs are the time of year when things get really exciting. Fortunately, sports fans aren’t the only ones being treated to contests as DIY investors and online brokerages have contests of their own making headlines. Of course some games take longer than others to win and require some creativity to get ahead (amirite Westworld fans?).

For many sports fans, playoffs are the time of year when things get really exciting. Fortunately, sports fans aren’t the only ones being treated to contests as DIY investors and online brokerages have contests of their own making headlines. Of course some games take longer than others to win and require some creativity to get ahead (amirite Westworld fans?).

Friday the 13th seems like an unlucky date for those in the path of a spring-time ice storm (sorry Toronto!) and for others, well, the search for ice is really just to keep drinks cold. Yes, this edition of the roundup is coming to you from the sunny and warm beaches of Huatulco, Mexico where the struggle to stay cool is real.

Friday the 13th seems like an unlucky date for those in the path of a spring-time ice storm (sorry Toronto!) and for others, well, the search for ice is really just to keep drinks cold. Yes, this edition of the roundup is coming to you from the sunny and warm beaches of Huatulco, Mexico where the struggle to stay cool is real.

Welcome to April 2018, where the invisible hand has taken to typing away tweets to move markets. The power of digital platforms and the importance of making deals coincidentally happen to be two important themes that Canadian online brokerages are also picking up on, although in a far less blustery manner.

Welcome to April 2018, where the invisible hand has taken to typing away tweets to move markets. The power of digital platforms and the importance of making deals coincidentally happen to be two important themes that Canadian online brokerages are also picking up on, although in a far less blustery manner.