Seasoned traders understand that in volatile situations, sometimes it’s best to sit on your hands. Though that advice would certainly be applicable outside the world of self-directed investing (*cough* Will Smith *cough*), within the world of self-directed investing, activity is tied to profitability, at least for online brokerages. So, it is a fine balance between taking action and being patient.

In this late-in-the-week edition of the Roundup, we check in on an important shift taking place at Canadian online brokerages that will see mutual funds come back into the spotlight for the next several months. Speaking of near term visibility, our next story looks at what one popular US online brokerage is noticing with respect to skepticism on the part of active investors. To close out, we highlight investor chatter about mutual fund commission charges and margin rate questions.

Can’t Fight this Fee-ing Anymore

One of the core tenets of self-directed investing is controlling or minimizing unnecessary costs.

Despite the characterization or popular mythology around self-directed investing as a “fast money” or a high activity endeavour, a significant portion of online investors are not very active and prefer to “take it slow and steady.” For example, a study on retail investors conducted by the Ontario Securities Commission in 2021 found that 43% of investors surveyed make fewer than 10 trades per year and 31% make 11 to 50 trades per year.

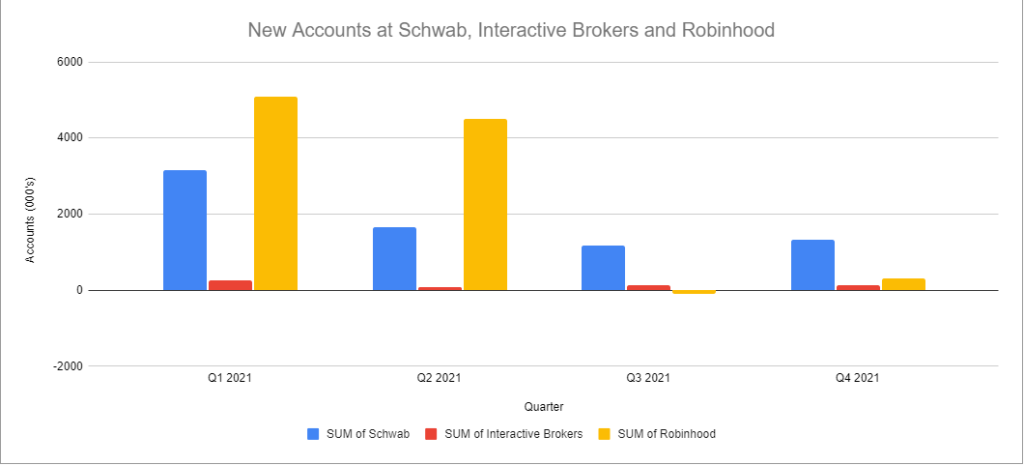

While activity is certainly influenced by what is out there to buy, prevailing opinions also suggest that up-front commissions have a part to play in influencing purchase behaviour. The rise and popularity of the zero-commission trading online brokerage Robinhood provided a dramatic example of this in the US, as has the growth of Wealthsimple Trade in Canada.

As most of us have come to learn, though, there is no such thing as a free lunch.

Despite the reluctance to go to zero commission trading on stocks, Canadian online brokerages are not unfamiliar with the practice of zero commission trading on mutual funds. Unfortunately, for many Canadian online investors, this has resulted in a scenario in which self-directed investors have been paying commissions for things that technically they’re not supposed to be paying commissions for from an online brokerage, namely, advice.

According to data associated with the class action lawsuits that have been launched against Canadian online brokerages, as much as $5 billion dollars in trailing commissions are alleged to have been paid “incorrectly” to online brokerages since 1993.

Though this story has taken a backseat during the pandemic, the timing of the deadline for online brokerages to transition investors into suitable alternative investments is nearing. As such, the response by some online brokerages to start charging commissions on mutual fund trades is surfacing in the news as is the access to previously unavailable mutual funds.

This month, for example, CIBC Investor’s Edge started to charge their standard commission rate, $6.95, to buy or sell mutual fund units. RBC Direct Investing rolled out new pricing this month as well, charging 1% of the gross trade amount up to a maximum of $50 for purchases of mutual funds. On the other end of the spectrum, it’s business as usual with no charge for mutual fund purchases at TD Direct Investing and BMO InvestorLine.

A side benefit of the new regulatory requirements is expanded choice for some online investors at firms like RBC Direct Investing. Previously, and much to the chagrin of self-directed investors, Mawer mutual funds were not available at RBC Direct Investing. As of this month, however, Mawer Investment Management announced that 13 of their funds are available at RBC Direct Investing.

With new regulations governing trailing commissions set to take effect June 1, there are still pockets of uncertainty relating to charges for mutual fund trades. The structural shift in product lines has been taking place over the past two years against the backdrop of the pandemic. However, with a deadline looming, the flurry of activity and announcements from online brokerages early this year suggests they are cutting it a bit close as far as communicating these changes to their clients. Ultimately, that could prompt a customer service risk, especially if there are any big market shocks that set off a surge of requests for contact centre support.

Although fundamentally different in spirit and appeal than individual equities or ETFs, the fact that mutual funds remain a very popular choice for certain DIY investors who do business with bank-owned online brokerages (say, those who might remember or know that REO Speedwagon hit referenced in this section’s title?) means that how individual banks approach the selection and pricing of mutual funds can be a differentiating factor. That is especially important to consider as online brokerages attempt to provision for an influx of younger investors.

There was some further fascinating commentary to that effect provided by Dan Rees, Group Head Canadian Banking, at the recent National Bank Financial Services Conference.

We want people to come for the advice and stay for the performance. So, younger individuals who don’t want to take advice and want to go DIY on their own. Generally speaking, those don’t work out that well, right? That said, we also know that we have sophisticated investors who do want to run their own money as part of managing their overall portfolio, so they may have a relationship with a portfolio manager and run 15% on their own, in our case in an iTRADE account. And we want to support both of those positions.

And I think what you’re going to continue to see, I think, is us introducing more channel options to address the different needs of each of those segments. I would say as a fiduciary, and we are very clear about this with the regulators, we are nervous about the propagation of — you can build your own portfolio and retire 15 years earlier by saving a few dollars on fees. We think it’s a very dangerous message to send to Canadians at a time where they’re very anxious even about their mortgage debt. People should remember, it’s very important for Canadians to get advice on banking, investments, insurance and debt, not just investments. And I think as we begin to see more and more feedback from young Canadians about how are they going to save for a mortgage, save for a house, they have to come in for a conversation on that. They can’t do that on their own around the kitchen table. Historically speaking, it’s not successful.

Another interesting angle to the mutual fund shuffle taking place at online brokerages is that it offers a hint of how commission free trading could be handled at bank-owned online brokerages. A great case in point is TD Easy Trade. The new service allows for 50 commission-free trades of stocks but has limited selection of ETFs to just TD products.

Like “commission free” mutual funds, commission free trading at bank-owned online brokerages is going to have to come with some kind of value capture.

Interestingly, with recent launches by Questrade of Questmortgage, Interactive Brokers with their push into credit cards and Robinhood even launching their cash card, there’s a clear trend of pureplay online brokerages adding some “traditional” banking services, creating what we consider to be a “race to the middle” between fintech firms and incumbent financial services firms.

Stepping Aside: Interactive Brokers’ Clients Prefer to Wait and See

One of the strategic places to pay attention to in the online brokerage market is with active investors. In a world of commission-free trading, it is interesting to ask who would actually pay commissions to an online brokerage for trading services. The answer: Interactive Brokers clients would.

In a short interview on CNBC, founder of Interactive Brokers, Thomas Peterffy, shared some interesting details about the status of cash and margin position for Interactive Brokers’ clients that seemed to suggest that they are atypically not borrowing money nor putting cash into positions. Of note, the typical profile of a customer is also something Peterffy shared, since the profile of assets Interactive Brokers customers has is significantly larger than say, Robinhood customers.

Why this was of particular interest is that, typically, volatile markets are favoured by active traders.

Ahead of periods of heightened uncertainty, Interactive Brokers has served as an interesting harbinger of near-term behaviour. They are typically agile at tightening margin requirements if they foresee risk to their firm. In this case, the conclusion arrived at by Peterffy is that Interactive Brokers clients aren’t buying in this market because they don’t buy the strength of the rally. They are selling, it seems, into strength.

If interest rates rising are a disincentive for margin trading, however, it would suggest that there is limited upside, at least in the near to medium term. The fact that investors that are both knowledgeable about markets and who are prepared to pay for quality trade execution are not seeing a favourable risk/reward seems to paint a cautionary tale at least to that style of investing activity.

The consequence of activity pulling back for stock trading among the most valuable category of online brokerage clients is something that would be difficult to approximate the impact to among Canadian online brokerages; however, it almost goes without saying that it isn’t ideal.

This active group is likely to play a much more prominent role in the planning for online brokerages going forward since they not only typically trade stocks but also options. And, as data has shown, the small category of very active traders (50+ trades per month) can generate substantial revenue (and are prepared to do so) so long as the trading experience is reliable.

Getting those investors to pay attention to online brokerages against a backdrop where there is skepticism on market direction and rising interest rates will be especially challenging. The limited number of Canadian online brokerages that could cater to these active traders appear to have their work cut out for them.

From the Forums

Take a Hike

The headline news is replete with interest rate chatter. Interesting (no pun intended) then that the pace of those rate changes is also in the spotlight and why one eagle-eyed investor in this post noted a rather sharp increase in the margin rates at a popular bank-owned brokerage.

Fund Times

Chatter around mutual funds at online brokerages is at an unusual high point. Commissions are once again in the spotlight and one question from a Reddit user is certainly indicative of what others are thinking: which online brokerages are now directly charging (or not) for mutual fund purchases and sales.

Into the Close

That’s a wrap on another edition of the Roundup. It’s been a choppy past few days; however, all eyes continue to be fixed on how fast and furious interest rates are going to climb. Whether we can all make the leap to a new normal of interest rates is what everyone is working to figure out.