After a bumpy week in the markets, it is nice to get to Friday. For Canadian readers, it’s Thanksgiving long weekend so that means Canadian markets will be closed on Monday while everyone digests the news and a whole lot of turkey.

On the heels of the major announcement last week from BMO InvestorLine, this week there was a flurry of activity with several Canadian discount brokerages launching new features for research and trading. The news wasn’t all smiles and sunshine though. While one discount brokerage was improving access to low cost funds, another discount broker decided that margin trading had started to become too risky for some stocks and subsequently raised margin requirements. Finally, a couple of forum posts on a pair of Canadian discount brokerages were worth sharing this week.

CIBC Investor’s Edge Announces New Features

After their recently announced RESP administration fee elimination, it seems like CIBC Investor’s Edge is again moving to improve their service offering to Canadian self-directed investors. This time, it looks as if research tools and education support are being given a lift. Specifically, this past week, CIBC Investor’s Edge announced that they are rolling out an improved ETF research centre with resources from Morningstar (such as screeners, educational materials and more) powering the section. ETF education and support materials are offered by other Canadian discount brokerages, with discount brokerages such as National Bank Direct Brokerage, Qtrade and RBC Direct Investing also offering “ETF Centres” too.

RBC Direct Investing Lowers Investing Threshold on Series D Mutual Funds

In a news release this past week, RBC Direct Investing announced that they are lowering their investment minimum on their Series D mutual funds from $10,000 to $500. This will certainly be of interest to those investors with smaller portfolio sizes and those looking for lower Management Expense Ratio (MER) investment products. For more information on the RBC Direct Investing Series D Funds, click here.

Qtrade Launches New Features

Major bank-owned discount brokerages weren’t the only ones busy launching new features, a major independent discount brokerage is quietly rolling out some of their latest improvements for users. This past week, Qtrade launched several new or improved features for clients including:

- A new model portfolio feature that allows clients to ‘follow’ different portfolio types

- An improved ETF centre that provides detailed information and research on ETFs (powered by Morningstar)

- Improved account transfers between brokerages

- Improved new issues centre

- Improved trading interface with improved quotes, order tracking and help resources

Look out for a more detailed look at these new features in an upcoming post. In the meantime, users might be interested to know that are also some hints by Qtrade of further exciting changes coming to their trading interface. Stay tuned!

Interactive Brokers Hiked Margin Requirements for certain stocks

Interactive Brokers laid the smack down on margin traders this week by hiking margin requirements for many recently popular momentum stocks. A move like this begs the question – why now? The following two articles (Article 1 & Article 2) from Zero hedge tackles why Interactive Broker with a very interesting series of theories. Be warned though, these articles are fascinating but could definitely leave readers feeling a little nervous about market directions in the near term.

From the Forums

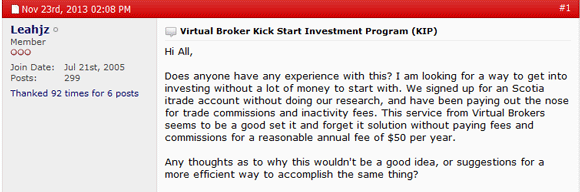

This past week, sifting through the chatter on discount brokerages on Canadian investing forums landed two interesting threads on CIBC Investor’s Edge and TD Direct Investing (TD Waterhouse) from Canadian Money Forum.

The first was a great discussion started by the user “2tire2work” who was interested in getting their personal finances in order – specifically getting going with some investing they had been thinking about. Click here to read more about what others in the forum had to say about which discount brokerage to choose.

In the second discount brokerage related post, dividend payment time was on the mind of the user “Gibor” who was curious to know why their dividend payments were getting posted to an account at CIBC Investor’s Edge at a different time from than at their account with TD Direct Investing. There were lots of interesting answers by forum members on this one – click here to read the thread.

That brings us to the end of the roundup for this week. Have a safe and wonderful Thanksgiving long weekend (for the Canadians!) and a great Columbus Day for those in the US. As a quick reminder, Canadian stock markets will be closed on Monday but US Markets will remain open for trading.

Amongst Canadian discount brokerages, it was supposed to be a quiet ride into the end of 2013. Alas, it was not to be. With a Boxing Day promotion launched by one of Canada’s discount brokerages this past week, the competition for Canadian investors officially hit a new high. This bodes well for self-directed investors going into 2014 as both pricing and services can be expected to improve from discount brokerages looking to gain an edge on one another. In the final (and shortened) weekly roundup of 2013, we’ll take a look at this latest disruptive deal as well as some of the interesting chatter from investors around the forums and social media.

Amongst Canadian discount brokerages, it was supposed to be a quiet ride into the end of 2013. Alas, it was not to be. With a Boxing Day promotion launched by one of Canada’s discount brokerages this past week, the competition for Canadian investors officially hit a new high. This bodes well for self-directed investors going into 2014 as both pricing and services can be expected to improve from discount brokerages looking to gain an edge on one another. In the final (and shortened) weekly roundup of 2013, we’ll take a look at this latest disruptive deal as well as some of the interesting chatter from investors around the forums and social media.

This week Canadians learned that for some of us, getting letters to and from the North Pole may get harder and also more expensive now that Canada Post may cut back on mail deliveries. Not to fear though, SparxTrading is still delivering the best roundup of Canada’s discount brokerage related news, rain or shine, snow or sleet (which basically describes Vancouver weather this past week!).

This week Canadians learned that for some of us, getting letters to and from the North Pole may get harder and also more expensive now that Canada Post may cut back on mail deliveries. Not to fear though, SparxTrading is still delivering the best roundup of Canada’s discount brokerage related news, rain or shine, snow or sleet (which basically describes Vancouver weather this past week!).

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

It’s Friday once more and with it brings a whole slew of discount brokerage related news and activities. As the calendar rolled over into a new month, there was the usual hubbub with new deals being offered and updated by some major discount brokerages. This past week also saw one major Canadian discount brokerage sponsor an investor education roadshow, and another celebrate a milestone birthday with a launch of some mobile trading platforms.

It’s Friday once more and with it brings a whole slew of discount brokerage related news and activities. As the calendar rolled over into a new month, there was the usual hubbub with new deals being offered and updated by some major discount brokerages. This past week also saw one major Canadian discount brokerage sponsor an investor education roadshow, and another celebrate a milestone birthday with a launch of some mobile trading platforms.