One of the great things about watching professionals in action is just how easy they make things look. If you’re Aaron Rodgers, airing out a game-winning pass with no time left on the clock just seems like a day’s work. While Canada’s discount brokerages don’t have quite the dramatic finishes that the NFL seems to produce, this past week brokerages have had their fair share of unexpected comebacks and champions that make winning look effortless.

This edition of the roundup is chalked full of commentary and perspective on one of the biggest weeks of the year. Kicking off the roundup is the review of this month’s deals and promotions and the signals that brokerages are moving more aggressively into 2016 than ever before. Next we dive into discount brokerage rankings season by looking at the two big names in Canadian brokerage rankings that published their results this week. Finally we take a look at the news and chatter across the discount brokerage space on social media and in the forums. Saddle up, this is going to be a fun ride.

Deals in Play

At the outset of December it looks as if at least two brokerages, HSBC InvestDirect and Questrade, are interested in spreading some holiday cheer in the form of new deals and promotions.

Starting first with Questrade. Late last month they relaunched their popular Apple Watch promotion – which is actually a $500 gift card to the Apple store. While the addition of yet another promotion brings the number of promotions to at least 8, the launch was interesting for two other reasons.

First, with the expiry date of this promotion well into March of 2016, this seems like one of the premiere offers Questrade will be putting forward heading into the coveted “RRSP season”. The timing of this offer just before the Christmas holiday buying season means that it might just be enough to tip someone into considering Questrade as an online brokerage. Further, the value of $500 at the Apple store for a $100,000 deposit makes it a competitive offering at this deposit level.

A second reason this offer is interesting is because Questrade continues to offer more incentives and promotions than any (or almost all) other online brokerages. Going into December, Questrade alone accounted for just about half of all of the promotions being offered. Alongside the offer for the Apple Watch, Questrade is also offering up an iPad Mini promo as well as other commission-free trading promos. For other Canadian discount brokerages, the fact that Questrade has continued to offer the number and diversity of offers should demonstrate that DIY investors are clearly interested in brokerages who are prepared to give in order to receive.

The second online brokerage to get into the giving spirit this month is HSBC InvestDirect. From December through to March 2016, HSBC InvestDirect is offering up 30 commission-free North American equity trades for individuals signing up for a new account. While this is not the first time HSBC InvestDirect has put forward a commission-free trading offer, it is interesting to note that they too have set their expiry date on this promotion well into March and have launched this offer a month before the end of the year signaling that perhaps HSBC InvestDirect is preparing to compete a little harder for new clients than they have in the recent past.

Like most other competitive marketplaces, these moves by Questrade and HSBC InvestDirect will not go unnoticed. The fact that both of these offers stretch well into 2016 are a signal to other brokerages that it is going to be a very competitive RRSP season and that the sooner they can bring interesting offers to market, the better.

BMO InvestorLine Goes for the Three-peat

This past week financial industry ranking firm Surviscor released their updated set of Canadian online brokerage rankings crowning BMO InvestorLine as their choice for top online brokerage yet again. These past few weeks have been good to BMO InvestorLine as they also took the prize for top online brokerage from the Morningstar awards, which are also very similar in structure to rankings/analysis underpinning the Surviscor ratings.

Below is a video from BNN of Surviscor President Glenn LaCoste giving his thoughts on the latest rankings and trends in Canadian discount brokerages.

In terms of scoring, Surviscor’s rating system included some new elements that weren’t present in years past, namely a ‘Service Level Assessment’ as well as a ‘Mobile Accessibility’ consideration.

One of the interesting components about the Surviscor analysis is that it takes into account over 4000 criteria when coming up with the final score. Of course, since those criteria are proprietary it is difficult to know exactly the weights that lead to the scoring.Even so, a look at the distribution of this year’s scores also shows just how tightly clustered most of the brokerages are according to Surviscor’s analysis.

The graph below (a histogram for the stats nerds) shows that most firms in the ranking have a score between 65% and 74%. What stands out when looking at this chart is just how poorly HSBC InvestDirect performed on this analysis compared to the rest of the firms profiled.

At the other end of the spectrum, BMO InvestorLine and Scotia iTRADE scored above most of the other brokerages but relatively close to one another. This is particularly interesting given the fact that standard commission pricing at both firms is very different.

In terms of BMO InvestorLine, standard commission pricing is in line with many other bank-owned brokerages at just under $10. Conversely, Scotia iTRADE’s standard commission pricing is still closer to $25. Thus, commission pricing is only part of what factors into making a firm rank well in these ratings and, according to these rankings, the overall experience between BMO InvestorLine and Scotia iTRADE may be too close for most to notice.

In fact, the scoring shows that according to these rankings, for about 50% of the brokerages, the experience is bound to be “pretty close” to another brokerage.

For DIY investors the take home message to keep in mind when considering the rankings is that these scores represent a snapshot in time. The industry is constantly evolving and so new features or improvements may show up in between ranking cycles which then in turn change the order in which these firms would be ranked. The fact that many discount brokerages are clustered around the same scores show that most firms do a reasonably decent and probably similar job in terms of the criteria measured by the Surviscor rankings, so it seems that personal preference will have a greater role to play for most DIY investors.

That said, these numbers also show that most brokerages are locked in a very tight race with one another. The big challenge in front of the brokerages for 2016 is just how they’re going to start separating themselves from one another.

2015 Globe and Mail Online Brokerage Rankings Released

Of course what would online brokerage rankings season be without the most widely anticipated and longest running ranking of Canadian brokerages?

Earlier today the Globe and Mail’s Rob Carrick published his annual review of twelve of Canada’s most popular online discount brokerages and there were certainly some surprises contained in this year’s rankings.

Starting first with the actual scores. In the 2015 rankings, there was a clear theme that the top three Canadian online brokerages according to Rob Carrick just happened to be non-bank owned brokerages.

Virtual Brokers has once again reclaimed its title as best online brokerage after having lost it last year to Qtrade Investor (who incidentally came in 2nd place this year). Following in third place was Questrade, a firm that has continuously been moving up the rankings for the past few years.

The battle between Qtrade Investor and Virtual Brokers may now be turning into somewhat of a rivalry as both of these firms continue to score well in the Globe’s brokerage rankings only narrowly edging one another out each year for the past 4 years. And, even though Questrade may have placed third, according to Rob Carrick’s comments on this brokerage, they may very well take top spot should they continue at their current pace.

For the bank-owned brokerages, the only bright spot appeared to be TD Direct Investing. With a revamped website and the implementation of long awaited features (such as the US Dollar RRSP account), TD Direct Investing scored the best among Canada’s bank-owned online brokerages with a grade of a B+.

The rest of the pack of bank-owned brokerages, however, seemed to draw less glowing praise, to put it mildly.

Interestingly, for the businesses with the biggest profits (i.e. the Canadian banks), the ability to create exceptional experiences (at least in the view of the rankings) fell far short of what they could do. One of the reasons often cited by industry insiders, is that the online brokerage arms of many banks just don’t get the resources and respect as some of the other banking units. Ironically, for many bank-owned brokerages, the marketing that their parent bank spends to create expectations for consumers tends to backfire when the bells and whistles and attention to product experience don’t make it to the wealth management arm of their business.

Perhaps the clearest case to be made in these results is that the smaller, independent brokerages are able to be more innovative than their bank-owned counterparts. Some might even argue that in order to compete effectively, the smaller players have to innovate to stay relevant.

Innovation, however, is not without its downsides either. With so much of today’s DIY investing experience tied to being online, being first to market or creating a new platform or website is one thing – having it work under normal and even stressful conditions, however, is something completely different. As we’ve seen time and time again this past year, releases of new software platforms, app updates and websites has not been smooth for any brokerage. For smaller brokerages in particular having technology go down (or misbehave) can create a cascading series of frustrations as they neither have the customer service resources nor the communication channels that larger brokers have to mitigate these kinds of scenarios.

In the case of this year’s Globe and Mail online brokerage rankings, however, there seemed to be an especially large component of the analysis, scoring and commentary devoted to the look and feel of brokerage websites. The argument for doing so, according to Carrick, is that commission pricing is no longer the biggest component to differentiating brokerages. Instead, client experience and more specifically, website experience is.

Another interesting observation about this year’s rankings was that they were not as lengthy or detailed as they have been in years passed (including compared to last year’s). While it is purely speculative, a great deal of the shine on DIY investing has been eclipsed by robo-advisors and a significant focus of the personal finance conversation has been about Canadian real estate. Add to that a fairly abysmal year for Canadian equities and it’s clearly been a tough time for DIY investing to get any positive headlines.

Clearly, many of Canada’s discount brokerages have their work cut out for them in 2016. With rankings season now over, the writing is on the wall for the Canadian discount brokerage industry: step up or step back.

The non-bank owned brokerages are going to have to continue to innovate in order to fend off their larger competitors. Large bank-owned brokerages clearly have to work both smarter and harder at becoming seen as leading edge technology firms – something that is tough and expensive to do given their size. Perhaps the clearest message of all, however, is that discount brokerages that are on ‘auto-pilot’ are probably at the biggest risk of making themselves appear obsolete. While it may be tough to rank first in multiple rankings, occupying the basement of multiple rankings is a sign that DIY investors will almost certainly use to stay away.

Event Horizon

Bundle up and hunker down, it’s a busy week ahead for discount brokerage-sponsored investor education events. Here are some upcoming sessions that may be of interest to yield hounds, those who are new to investing, curious about trading strategies, and options enthusiasts. Tax efficient investing, technical analysis, and registered accounts round out this upcoming week’s selection.

December 7

Scotia iTRADE – Dividends, Balanced Portfolios and the Quest for Yields with Larry Berman

December 8

TD Direct Investing – Alternatives to Mutual Funds: Learn What Else Is Out There

TD Direct Investing – Options as an Income Strategy

December 9

TD Direct Investing – The Evolution of Indexing

TD Direct Investing – Technical Analysis – Advanced Indicators

TD Direct Investing – Tax Efficient Investing

December 10

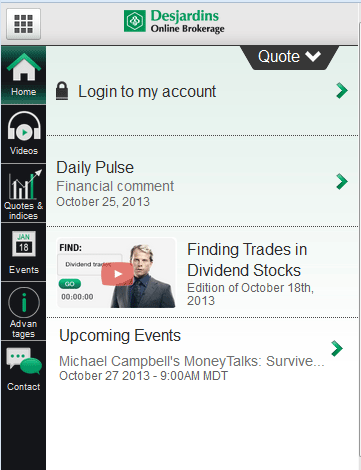

Desjardins Online Brokerage (Disnat) – Discover the Benefits of the TFSA

Scotia iTRADE – Trading The Double Top with AJ Monte

From the Forums

In this edition of the forums sweep we found an update to this post from the RedFlagDeals investing section that highlights what will be a disappointing change for many Norbert’s Gambit fans at one of Canada’s largest brokerages.

Into the Close

That’s a wrap for this week’s roundup. Now that Black Friday and Cyber Monday have come and gone, there still might be a chance to save big. Speaking of big saves, here’s a treat for the Leafs fans and their new goalie Sparks (yep, we already like him) getting into the saving spirit. Have an awesome weekend!

This past week, many DIY investors have been turning their attention to ways to spend their money rather than to grow it. Although online traders have typically avoided coming to blows with each other

This past week, many DIY investors have been turning their attention to ways to spend their money rather than to grow it. Although online traders have typically avoided coming to blows with each other

What a week of wacky data to digest. From May the Fourth being with us, to Cinco de Mayo to the NDP landslide win in Alberta to Deflategate to stocks being called out for being overvalued and the markets going up anyway. It was definitely one of those stranger-than-fiction-headscratchers kind of weeks. Not to be left out, Canadian discount brokerages and DIY investors have a bit of headscratching to do with the release of yet another discount brokerage ranking.

What a week of wacky data to digest. From May the Fourth being with us, to Cinco de Mayo to the NDP landslide win in Alberta to Deflategate to stocks being called out for being overvalued and the markets going up anyway. It was definitely one of those stranger-than-fiction-headscratchers kind of weeks. Not to be left out, Canadian discount brokerages and DIY investors have a bit of headscratching to do with the release of yet another discount brokerage ranking.

It’s Friday the 13th. Tomorrow is Pi Day (3/14). As Jerry Seinfeld might irrationally proclaim, what is the deal with all these numbers?

It’s Friday the 13th. Tomorrow is Pi Day (3/14). As Jerry Seinfeld might irrationally proclaim, what is the deal with all these numbers? What do shows like Big Bang Theory, Dancing with the Stars and Sons of Anarchy have to do with Canadian Discount Brokerages? Well, if you guessed fall ratings then Bazinga!

What do shows like Big Bang Theory, Dancing with the Stars and Sons of Anarchy have to do with Canadian Discount Brokerages? Well, if you guessed fall ratings then Bazinga!

Also, with changes happening constantly taking a snapshot of who the “best” online brokerage is (or was) as of a certain point in time of the year doesn’t necessarily hold true several months down the road.

Also, with changes happening constantly taking a snapshot of who the “best” online brokerage is (or was) as of a certain point in time of the year doesn’t necessarily hold true several months down the road.

Fortunately for self-directed investors, one Canadian research firm (Dalbar Canada) measures client experience for most of the Canadian discount brokerages as part of their direct brokerage service evaluation (DBSE) program. As part of the DBSE, Dalbar Canada also recognizes the high achievers in their evaluation with their Direct Brokerage Service Award.

Fortunately for self-directed investors, one Canadian research firm (Dalbar Canada) measures client experience for most of the Canadian discount brokerages as part of their direct brokerage service evaluation (DBSE) program. As part of the DBSE, Dalbar Canada also recognizes the high achievers in their evaluation with their Direct Brokerage Service Award. Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.  Coming into the home stretch of October, equity markets are continuing push higher. The constant string of ‘good news’ is something that may lure more investors back into the markets, which is also probably why there are some major initial public offerings (IPOs) also being announced.

Coming into the home stretch of October, equity markets are continuing push higher. The constant string of ‘good news’ is something that may lure more investors back into the markets, which is also probably why there are some major initial public offerings (IPOs) also being announced.