Staying on top of all of the discount brokerage action going on this January feels a bit like chasing either Russell Wilson or Colin Kaepernick around the field. The competition between these two elite quarterbacks pales in comparison, however, to that of Canadian brokerages.

Staying on top of all of the discount brokerage action going on this January feels a bit like chasing either Russell Wilson or Colin Kaepernick around the field. The competition between these two elite quarterbacks pales in comparison, however, to that of Canadian brokerages.

This past week saw a game-changing commission drop announcement by a major bank-owned online brokerage that has probably got the other brokerages scrambling. Against the backdrop of that news, there were still yet more deals being announced and the investor forums were ablaze with cheers and jeers on what it all means. Let’s kickoff this week’s roundup with the biggest news from RBC.

RBC Direct Investing Drops Commission Pricing

It was tough to measure what dropped further this week: the prices for commissions at RBC Direct Investing or the jaws of their competitors. RBC lowered the boom this week with their announcement that their standard commission rate is now $9.95 flat for all clients. The reactions were swift across social media and on forums as to the gravity of this announcement and what it means for investors as well as the discount broker competitors. While most of the reactions were positive, there were reactions from some individuals that felt that customer service wait times would be bogged down by the flood of new clients.

How things play out is only something we can wait and watch however to put it into perspective, the price drop from ~$29 down to $9.95 puts RBC Direct Investing’s commission pricing in line with that of the lowest cost discount brokerages – Questrade and Virtual Brokers. The fact that they’re offering $9.95 flat means that in some instances, RBC may be cheaper because they won’t be passing through ECN fees. Of course, in addition to lowering the price, they’ve also simplified it. Gone are the days of elaborate calculations as to what the commission charge will be for a stock under a certain price and of a certain order size.

In a nutshell, while investors stand to benefit from the move and for RBC Direct Investing’s competitors, especially the lower cost brokerages, are going to have to get very creative and/or very efficient. Introducing steep inactivity fees or raising fees is no longer a viable strategy going forward. For RBC’s larger bank-owned peers, if mortgage-rates were any indicator, the lowering/simplifying of standard commission fees is now just a matter of time.

January is Deal-icious for Discount Brokerage Accounts

Staying on the RBC Direct Investing theme, the cherry on the sundae was the announcement that RBC Direct Investing is also offering up 20 commission-free trades with a new sign up. These trades can be used for up to 90 days after account funding. Co-incidentally, HSBC InvestDirect also quietly put a deal back on their homepage. In HSBC’s case, for accounts that switch over to them, InvestDirect is willing to cover up to $150 of transfer fees and offer 5 commission-free equity trades. Click the following link to learn more about the latest discount brokerage deals & promos. Both RBC and HSBC were recipients of top honors in the Dalbar direct brokerage client service evaluation, the results of which were announced last week.

From the Forums

Canadian investor forums were ablaze with the move by RBC to lower their commissions. As the time draws closer to the RSP deadline for this year, the interest level and topics of discussion will start to pick up as they did this week.

The Wave

There were more than a few threads that were started in response to the RBC Direct Investing commission announcement. Here are two of the more popular ones from Canadian Money Forum and from RedFlagDeals.

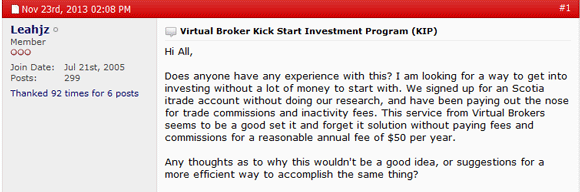

Going Solo

In this post from Canadian Money Forum, forum user ‘intricated’ contemplates how to make the jump from having a financial advisor to going it alone. Find out some of the hazards and experiences other users flagged as being important when deciding to become a DIY investor.

Thanks for going the distance on this one. Have a great weekend and of course, go Seahawks.

This week it was bone-chillingly cold everywhere in Canada except for the discount broker deal space (and maybe Vancouver). Several big promotions heated up the deals space this week in what is likely a sign of the fierce competition for self-directed investors’ assets to come this RSP deadline season. Just in time for all that were a couple of big announcements too. One from a discount broker lowering their commission fees and another from a discount brokerage customer service evaluation. Closing out the roundup, we’ll take a look at the investor forums for some valuable lessons for those venturing into wild west of online trading.

This week it was bone-chillingly cold everywhere in Canada except for the discount broker deal space (and maybe Vancouver). Several big promotions heated up the deals space this week in what is likely a sign of the fierce competition for self-directed investors’ assets to come this RSP deadline season. Just in time for all that were a couple of big announcements too. One from a discount broker lowering their commission fees and another from a discount brokerage customer service evaluation. Closing out the roundup, we’ll take a look at the investor forums for some valuable lessons for those venturing into wild west of online trading. In a related vein, this past week

In a related vein, this past week

Although the roll-out hasn’t officially hit full stride, Canada’s second largest stock exchange, the CNSX, is rolling into 2014 with a change to its name and logo. Going forward the CNSX will now be known as The Canadian Securities Exchange or The CSE. We’ll continue to provide more information on what the change will mean for the exchange and what the impact will be to retail investors. The new website can be found (appropriately) at

Although the roll-out hasn’t officially hit full stride, Canada’s second largest stock exchange, the CNSX, is rolling into 2014 with a change to its name and logo. Going forward the CNSX will now be known as The Canadian Securities Exchange or The CSE. We’ll continue to provide more information on what the change will mean for the exchange and what the impact will be to retail investors. The new website can be found (appropriately) at  Amongst Canadian discount brokerages, it was supposed to be a quiet ride into the end of 2013. Alas, it was not to be. With a Boxing Day promotion launched by one of Canada’s discount brokerages this past week, the competition for Canadian investors officially hit a new high. This bodes well for self-directed investors going into 2014 as both pricing and services can be expected to improve from discount brokerages looking to gain an edge on one another. In the final (and shortened) weekly roundup of 2013, we’ll take a look at this latest disruptive deal as well as some of the interesting chatter from investors around the forums and social media.

Amongst Canadian discount brokerages, it was supposed to be a quiet ride into the end of 2013. Alas, it was not to be. With a Boxing Day promotion launched by one of Canada’s discount brokerages this past week, the competition for Canadian investors officially hit a new high. This bodes well for self-directed investors going into 2014 as both pricing and services can be expected to improve from discount brokerages looking to gain an edge on one another. In the final (and shortened) weekly roundup of 2013, we’ll take a look at this latest disruptive deal as well as some of the interesting chatter from investors around the forums and social media.

Here we are just a few days away from Christmas and while it seemed that things would settle down going into the end of the year, the discount brokerage world has been anything but quiet. In this week’s roundup, news of fees dropping from a major Canadian discount brokerage kicks things off. Next, the major story, an online brokerage in the US takes a stab at completely commission free trading. Finally, we round off with a trio of interesting topics for DIY investors courtesy of the Canadian investing forums.

Here we are just a few days away from Christmas and while it seemed that things would settle down going into the end of the year, the discount brokerage world has been anything but quiet. In this week’s roundup, news of fees dropping from a major Canadian discount brokerage kicks things off. Next, the major story, an online brokerage in the US takes a stab at completely commission free trading. Finally, we round off with a trio of interesting topics for DIY investors courtesy of the Canadian investing forums.

This week Canadians learned that for some of us, getting letters to and from the North Pole may get harder and also more expensive now that Canada Post may cut back on mail deliveries. Not to fear though, SparxTrading is still delivering the best roundup of Canada’s discount brokerage related news, rain or shine, snow or sleet (which basically describes Vancouver weather this past week!).

This week Canadians learned that for some of us, getting letters to and from the North Pole may get harder and also more expensive now that Canada Post may cut back on mail deliveries. Not to fear though, SparxTrading is still delivering the best roundup of Canada’s discount brokerage related news, rain or shine, snow or sleet (which basically describes Vancouver weather this past week!).

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.