With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

And the award for best online brokerage goes to…..

It’s been a busy year for the titles of best discount broker/best online broker. This year, 7 out of the 14 major Canadian discount brokerages (HSBC InvestDirect, Scotia iTrade, Interactive Brokers, National Bank Direct Brokerage, BMO InvestorLine and Virtual Brokers ) have won some kind of ‘best’ title in the discount brokerage/online brokerage space. Of course, each of the rankings and evaluations uses a different method to evaluate the brokerages, however with so many “best online brokers” it can be tough to choose. Thankfully there are tools to help simplify comparing discount brokerages on price and key features. Look out for the full review of all of this year’s awards and a look ahead to 2014 coming soon.

This past week, BMO InvestorLine was awarded the crown for Best Online Brokerage by the judging panel (Paul K. Bates, Jonathan Chevreau, Jon Purther and Glenn A. Lacoste) from the Morningstar Awards. Although Qtrade did not win this year, they got a couple of honourable mentions. For more information on the win, check out this press release and also this video interview of BMO InvestorLine President & CEO Viki Lazaris with Morningstar’s Ashley Redmond.

At Scotia iTrade, Practice Makes Perfect

Scotia iTrade has now widely rolled out practice accounts for those clients interested in trading with pretend money instead of real money. Practice accounts are a great tool to help self-directed investors get oriented to their online trading accounts and become familiar with the process of trading. For those seeking to improve their trading performance, practice accounts are also great tools for building discipline and testing trading strategies. Other Canadian discount brokerages that offer practice online trading accounts include RBC Direct Investing, Interactive Brokers, Virtual Brokers and TD Direct Investing (US Trading Platform).

On the D List

Earlier this year, RBC Direct Investing announced that it was lowering the threshold for participating in the RBC Series D mutual funds. Given the interest in low cost ETFs and mutual funds, this certainly raised more than a few eyebrows in the mutual fund industry. Fast forward to this week and it seems that interest is turning into action with the announcement from RBC Direct Investing that BlackRock Canada, Invesco Canada and Mackenzie Investments will also be planning to roll out funds that fit into the Series D family. Check out Rob Carrick’s article in the Globe and Mail for a good overview of the Series D funds and how they stack up against ETFs.

From the Forums:

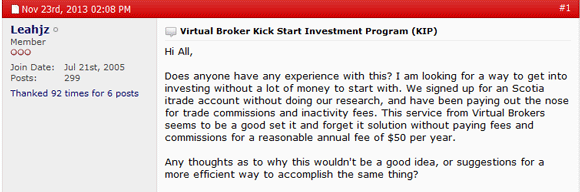

Curiosity About the KIP

Amidst all the Black Friday deal hunting, on the RedFlagDeals.com forum, there was an interesting post about Virtual Brokers’ recently launched Kick Start Investment Program (KIP). Check out what the investor tribe had to say to user Leahjz’s questions about using the KIP.

That’s it for this week’s edition of the roundup. Happy shopping everyone!

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Coming into the home stretch of October, equity markets are continuing push higher. The constant string of ‘good news’ is something that may lure more investors back into the markets, which is also probably why there are some major initial public offerings (IPOs) also being announced.

Coming into the home stretch of October, equity markets are continuing push higher. The constant string of ‘good news’ is something that may lure more investors back into the markets, which is also probably why there are some major initial public offerings (IPOs) also being announced.

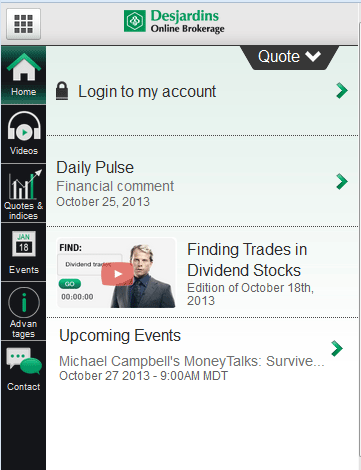

It’s Friday once more and with it brings a whole slew of discount brokerage related news and activities. As the calendar rolled over into a new month, there was the usual hubbub with new deals being offered and updated by some major discount brokerages. This past week also saw one major Canadian discount brokerage sponsor an investor education roadshow, and another celebrate a milestone birthday with a launch of some mobile trading platforms.

It’s Friday once more and with it brings a whole slew of discount brokerage related news and activities. As the calendar rolled over into a new month, there was the usual hubbub with new deals being offered and updated by some major discount brokerages. This past week also saw one major Canadian discount brokerage sponsor an investor education roadshow, and another celebrate a milestone birthday with a launch of some mobile trading platforms.