It’s hard to believe but the halfway point of 2018 is just around the corner. Heading into the Canada Day long weekend, it’s an opportune time to review the latest activities from the second quarter of 2018 and see what stories made waves, as well as some of the trends we see taking shape in the online brokerage space.

In this edition of the roundup, we’ll take a look back at the (calendar) Q2 of 2018 and review what we think are the most compelling stories and developments. Suffice to say technology has been a key driver of change, but it also seems like the fundamental economics of the space are experiencing a shift. As usual, we’ll also serve up some DIY investor content treats with DIY investor tweets and close out with interesting forum posts.

Making the Highlight Reel

Before jumping in to Q2, a quick recap of what happened in Q1 is available in this roundup from early April. In the first quarter of the year, some of the dominant stories included online brokerage outages, RSP season promotions and online brokerage rankings from the Globe and Mail.

At the end of the second calendar quarter of 2018 there are a number of interesting stories to reflect on as well as some hints dropped and telegraphed by Canadian discount brokerages as to what’s coming around the corner for the summer of 2018.

Acquisitions

One of the biggest news stories to emerge in Q2 was the announcement that independent online brokerage, Jitneytrade, was being purchased by wealth management giant Canaccord. The deal, the terms of which were not published, means that the small independent online brokerage players in the Canadian space have all but disappeared. Only Questrade stands out as the online brokerage that is not owned by a larger parent financial brand, bank or other significantly larger financial services company.

Last year saw the purchase of BBS Securities (parent to Virtual Brokers) and the merger of Qtrade Investor and Credential Direct. This trend towards consolidation or purchase by deeper pocketed investment firms is a signal that the online brokerage space is in transition. Some services, such as Jitneytrade, cater to a very select group of active/professional traders – so the requirements for a broader investor profile are not as prominent as firms such as Qtrade Investor or Virtual Brokers. With bigger backers, however, the online brokerage platforms will really be put to the test to see if they’ve got what it takes to challenge the big bank online brokerages.

Online Brokerage Reviews – Moneysense magazine

In late May, the online brokerage reviews and rankings prepared by Moneysense magazine were published. Our roundup post on the Moneysense reviews compared the ratings from last year to this, and looked at the categories that these rankings included this year such as:

- Best overall online brokerage

- Best discount brokerages for ETFs

- Best online brokerages for mobile and market data

- Best online brokerages for low fees

- Best online brokerages for design and user experience

One of the big stories from this year’s Moneysense rankings is that Qtrade Investor came out on top, narrowly edging out Questrade in the category of “best overall” online brokerage. Interestingly the top four firms last year are once again in the top four this year. Joining Qtrade Investor and Questrade are Scotia iTRADE and BMO InvestorLine, although it should be noted that these latter two bank-owned online brokerages scored notably lower than either Qtrade Investor or Questrade.

Looking at the results from a category point of view showed that different online brokerages have particular strengths in certain areas. For example, HSBC InvestDirect and Questrade were ranked best for fees; Questrade was ranked highest for initial impression; TD Direct Investing was ranked best for Data while National Bank Direct Brokerage was ranked best for ETFs.

All told, when it came to online brokerage rankings, Qtrade Investor performed exceptionally well, managing to top both the Globe and Mail and Moneysense rankings and placing second overall in the last J.D. Power Investor Satisfaction rankings. From a competitive point of view, this provides a lot of positive momentum for Qtrade Investor as they transition into life as the dominant non-bank online brokerage brand in Western Canada (now that Credential Direct has merged). It will be particularly interesting to see how a considerably bigger Qtrade Investor decides to challenge bank-owned rivals in ways that Qtrade has traditionally avoided, such as with more prominent advertising or with platforms/products for active investors (or even traders) – the affiliation with Desjardins Online Brokerage (and in particular Disnat) – could present a compelling wildcard that would almost certainly cement Qtrade Investor’s status (among its peers) as the brand to beat going forward.

V for Volatility

The past several years since the financial meltdown, markets have been mostly on a steady track upwards. This year, however, that all changed. Since the election of Donald Trump, markets – in particular US equity markets – have done really well. But, as all seasoned traders know, the trend is your friend until it ends. For US online brokerage, Interactive Brokers, the move on their part to raise the cost of borrowing for clients requiring margin of US stocks was a direct response to the data pointing to a pending downturn. Well, they called it, and earlier in the second quarter of this year, Interactive Brokers published the results of having prepared well in advance of the pending volatility. The result, Interactive Brokers was able to limit losses to a fraction of the losses experienced by names such as TD Ameritrade and E*TRADE.

Uptick in Deals Activity

On the deals and promotions front, Q2 of 2018 presented a little bit of volatility of its own as the post-RSP dip in activity also took down a number of online brokerage deals and promotions. That said, it didn’t take too long for a rebound to take hold so that by the time the quarter was winding down, offers were back on the table and during the quarter, a short lived but very intriguing offer from RBC Direct Investing also surfaced indicating that this big player is capable of some nimble promotional work.

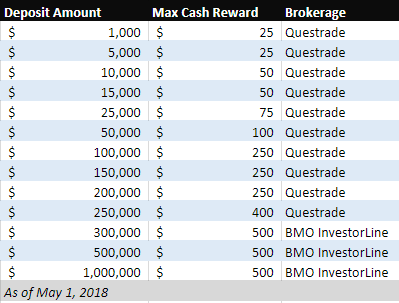

Cash back offers in particular saw a resurgence in Q2, with BMO’s SmartFolio launching a new cash back offering and Scotia iTRADE also launching a cash back offer (in the form of a gift card) for existing clients.

Be sure to check out the deals action this summer as the online brokerages get themselves ready for the fall and invariably try to find some winning combination for investors active during the summer.

What’s Coming Up

In addition to setting the world on fire with the Yanny vs Laurel craze, social media also proved itself to be useful in providing DIY investors some hints as to what several online brokerages have coming up in the near future.

Keeping Currency

One great example comes from Scotia iTRADE, whose service staff let one tweeter know that USD registered accounts are ‘on their way’ (i.e. close to completion) for DIY investors. This kind of insight is easy to miss but will be a notable value driver when it does go live. We also expect there to be quite a bit of noise generated when it is released which means even more iTRADE commercials.

Platform Leap

Another interesting tip that came from social media was from TD Direct Investing, who let followers know about a webinar that provided a first look at the new Advanced Dashboard to be rolled out to clients. This new approach to rolling out feature releases appears to be something TD is testing the waters with – as a recent enhancement for French-speaking users was also telegraphed on Twitter in mid-May and was confirmed to be live as of this past week. As for the Advanced Dashboard, we’ll be watching to see what the reaction is like to a new user experience and to upgraded trading features.

Also rolling out in the summer is a new trading platform from Virtual Brokers – VB Wave. We first spotted the new platform on the VB website in early June however it appears to still be in active development with the soft roll out intended to help iron out any wrinkles in performance or user experience that may arise. In any case, the addition of a new trading platform to the suite of Virtual Brokers’ product line positions them as having one of the most diverse selections of trading platforms available to any online brokerage in Canada. Stay tuned.

Discount Brokerage Tweets of the Week

Discount

Brokerage Tweets – Curated tweets by SparxTrading

Into the Close

That’s a wrap for this pre-Canada Day edition of the roundup. Although markets are going to be closed in Canada on Monday, there’s no doubt that traders will want to keep an eye out for the fallout from the trade tariffs which are set to take effect July 1st. For all the folks in Ontario, stay cool and for the folks out west in BC, feel free to blame it on the rain. On behalf of the Sparx Trading team, Happy Canada Day to everyone!!

There are lots of reasons to cheer as summer officially started this week and, of course, its Friday. For Canadian DIY investors, and much of the world really, the news coming out of the US has dominated airwaves. And, while nobody really knows exactly what’s going to happen next, it’s interesting to see how the leaders of online brokerages in the US are positioning themselves in this uncertain environment.

There are lots of reasons to cheer as summer officially started this week and, of course, its Friday. For Canadian DIY investors, and much of the world really, the news coming out of the US has dominated airwaves. And, while nobody really knows exactly what’s going to happen next, it’s interesting to see how the leaders of online brokerages in the US are positioning themselves in this uncertain environment. There is no doubt that deal making is an art. Sometimes it’s a Michelangelo, sometimes it’s a Pollock, sometimes it’s a Vandelay. In either case, online brokerages know that like beauty, a good deal is in the eye of the beholder. This week we know we’ve seen all kinds of ‘deals’ make the news but we’ve spotted a few which might have flown under the radar with all of the other hubbub going on.

There is no doubt that deal making is an art. Sometimes it’s a Michelangelo, sometimes it’s a Pollock, sometimes it’s a Vandelay. In either case, online brokerages know that like beauty, a good deal is in the eye of the beholder. This week we know we’ve seen all kinds of ‘deals’ make the news but we’ve spotted a few which might have flown under the radar with all of the other hubbub going on.

As any seasoned investor knows, the stock market is one very big voting machine. And, while there is no ‘leader’ per se, those stocks that get to the top are those that enrich their shareholders. Heading into the end of this week, there’s certainly been a lot of news about politics, which has everyone guessing what’s coming next. For online brokerages, figuring out how to understand the human angle of this market is going to keep a lot of folks very busy these next few months.

As any seasoned investor knows, the stock market is one very big voting machine. And, while there is no ‘leader’ per se, those stocks that get to the top are those that enrich their shareholders. Heading into the end of this week, there’s certainly been a lot of news about politics, which has everyone guessing what’s coming next. For online brokerages, figuring out how to understand the human angle of this market is going to keep a lot of folks very busy these next few months.

Even though it was a tough week for hacking scandals, pipeline purchases and provincial politics, none of it mattered because

Even though it was a tough week for hacking scandals, pipeline purchases and provincial politics, none of it mattered because

Though this was a short week because of the holidays, there was still a healthy dose of news to digest and trade around. For Canadian online brokerages, the race is on not only to report some of the big news but to put a creative spin on it.

Though this was a short week because of the holidays, there was still a healthy dose of news to digest and trade around. For Canadian online brokerages, the race is on not only to report some of the big news but to put a creative spin on it.

Despite having captured the imagination of the internet and having squandered so many people’s valuable time there’s a lesson in here for online brokerages, which is to get attention online, you have to be interesting.

Despite having captured the imagination of the internet and having squandered so many people’s valuable time there’s a lesson in here for online brokerages, which is to get attention online, you have to be interesting.

Eventually spring was bound to show up. And, like the green shoots, flowers and sunshine, it’s a time for change and opportunity. Fortuitously, Canadian discount brokerages are also taking their cues from spring and rolling out some interesting new items for the season.

Eventually spring was bound to show up. And, like the green shoots, flowers and sunshine, it’s a time for change and opportunity. Fortuitously, Canadian discount brokerages are also taking their cues from spring and rolling out some interesting new items for the season.

The old trading adage of sell in May and go away clearly did not apply to this week’s market activity. It’s still early enough in the month that anything can happen, however. With the announcement of the end of decades of hostilities between North and South Korea, it’s as good as any segue into the action taking place in the Canadian discount brokerage space.

The old trading adage of sell in May and go away clearly did not apply to this week’s market activity. It’s still early enough in the month that anything can happen, however. With the announcement of the end of decades of hostilities between North and South Korea, it’s as good as any segue into the action taking place in the Canadian discount brokerage space.