[Updated: Jan 31/2014] *While we thought the beginning of January would be a busy time for deals, we didn’t know it would be THIS crazy. Since the beginning of the month there have been quite a few big announcements. Read below for more details* Welcome to the first discount brokerage deals post of 2014! 2013 was a great year for self-directed investors looking for deals & promotions when opening an online trading account. This past year the promos pitched from Canadian discount brokerages included:

[Updated: Jan 31/2014] *While we thought the beginning of January would be a busy time for deals, we didn’t know it would be THIS crazy. Since the beginning of the month there have been quite a few big announcements. Read below for more details* Welcome to the first discount brokerage deals post of 2014! 2013 was a great year for self-directed investors looking for deals & promotions when opening an online trading account. This past year the promos pitched from Canadian discount brokerages included:

- commission rebates

- cash back offers

- referral bonuses and

- other incentives (such as AirMiles and iPad minis)

If 2013 was any indication, this year’s competition for new accounts will be even more fierce amongst discount brokerages. Coming into 2014 one discount brokerage (Questrade) actually went so far as to launch a week-long promotion on Boxing Day. So, while several discount brokerages have extended the deadlines on existing offers well into 2014, they may need to adjust that strategy if/when more aggressive offers start showing up. In terms of timing, with RRSP season right around the corner, there is a good chance DIY investors are going to see some interesting offers surface in the near future. And on that note, let’s launch into the first deals post for 2014.

Expired Deals

The end of December took with it a couple of discount brokerage deals. First, the TD Direct Investing offer of 50 free trades (which expired on Dec. 20th) and also somewhat mysteriously, the HSBC InvestDirect 50 trade offer. Why the mystery? Just before the end of the month HSBC InvestDirect had extended the deadline for their offer into March of 2014 however at the writing of this post (on Jan. 1) the offer has been removed from their website. We’ll stay on top of this one to see if the offer does come back in 2014.

Pending Deals

[Update: Jan 2/2014 – Scotia iTrade has now updated terms and conditions with a new expiry date on the refer-a-friend offer. This deal has now been moved to the extended deals section] The Scotia iTrade refer-a-friend offer is back in this section at the time of writing (Jan. 1). The Scotia iTrade website shows the offer available but the terms and conditions are not yet updated beyond Dec. 2013. We’ll check back to see if they extend this offer again and to what date.

Extended Deals

The trend towards extending deals continues with two discount brokerages. First, Disnat has extended the deadline on their $300 commission credit offer out until the end of March 2014. Second, BMO InvestorLine has extended their Refer-a-Friend promotion offer well out into next year with the new deadline for this offer being October of 2014. [Updated: Jan 2/2014 – Scotia iTrade’s refer-a-friend deal has now been extended to January 31, 2014]

New Deals

Updated: Jan 31/2014 Even though this is the last day of the January, there was another deal that caught our attention from BMO InvestorLine. The offer is in celebration of the launch of the traditional Chinese version of the BMO InvestorLine website and also in celebration of Chinese New Year. For this promotion, those who deposit a minimum of $25,000 may qualify for $88 cash back. See the table below for further details.

Updated: Jan 28/2014 CIBC Investor’s Edge is having a ‘flash promotion’ of sorts on top of their ‘customer appreciation’ program. From January 26th until February 1st CIBC Investor’s Edge is offering new clients either a) $400 and 50 equity trades for a $50,000 deposit or b)$200 cash back and 25 equity trades. The commission-free trades are good for up to one year and they will not be charged up front (so there is no waiting for a rebate). This is an ‘in branch’ promotion that lasts until Feb 1st so unfortunately detailed terms and conditions are not available online.

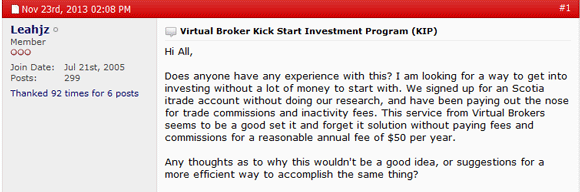

Updated: Jan 27/2014 As January draws to a close, Virtual Brokers has jumped into the deal pool by offering a 25 free trade offer for new clients that are good for use for up to one year. The minimum deposit to be eligible for this offer is $1,000. According to the terms and conditions, the rebates for commission free trades takes place within 8 weeks of the last trade being used so the rebate depends on usage of the ‘free’ trades. Be sure to read the terms and conditions (link below) for full details.

Updated: Jan 21/2014 Another deal spotted this January is the commission credit offer by National Bank Direct Brokerage (NBDB). NBDB is offering $500 in commission credits for new accounts opened with $20,000 or more, and a $1,000 credit for account deposits of $100,000. Reimbursement takes place after 90 days according to the schedule laid out in their terms & conditions.

Updated: Jan 14/2014 Even though there are more deals to come for January, the offer announced today by RBC Direct Investing comes in conjunction with lowered commission-fee announcement and is most certainly going to make waves with other discount brokerages as well as with investors. In terms of the deal, RBC Direct Investing is offering 20 commission-free trades (on equities or ETFs) that are good for up to 90 days.

Updated: Jan 13/2014 Questrade has reintroduced it’s “unlimited” trading offers once again. With this deal, new or existing clients can get 1, 2 or 3 months of commission-free trading (depending on the deposit) when they open a new TFSA, registered or margin account.

Updated: Jan 11/2014 – A pair of deals/offers also released this week: Update 1: Credential Direct has an offer to waive their $50 RSP administration fee for those who deposit $5000 into their RSP account as well as $5000 into a TFSA or cash account. According to their fee sheet, Credential Direct charges an administration fee of $50 per year on RSPs with balances less than $15,000. Update 2: BMO InvestorLine has announced yet another offer this month. They are offering cash back for those new or existing clients who open an RSP and/or TFSA accounts. For deposits of $25,000 or more, the cash back reward is $100 and for deposits of $50,000 or more, the cash back reward is $250. This deal is not listed on the front end of the website however a link is provided to the info below.

Updated: Jan 8/2014 – There have been a number of deals/promotions announced by discount brokerages over the past 2 days.

Update 1: First up was an expected update from BMO InvestorLine. Their current offer (which expires in March 10 2014) is a bit of a twist on their previous $250/250 free trade offer. In the current promotion, the total cash rebate can be as high as $300 and 300 commission-free trades offered (up to a total maximum of $3000 in commission fees). The terms and conditions are incredibly long (~1650 words before examples) so be prepared for some reading to thoroughly understand the deal. The examples are nicely laid out so that helps in understanding how this offer works.

Update 2: Qtrade Financial has also jumped into the promotional pool by offering a contest for new deposits. Qtrade is holding a draw for a grand prize of $10,000 open to new and existing clients who deposit at least $10,000 in cash or securities into an account. Every $10,000 gets the depositor 1 entry into the draw. There are also monthly draws for a $1,000 Visa gift card in February, March & April. The terms and conditions are also a bit lengthy but explain how it works well. The contest runs from January 1, 2014 to March 31, 2014. As this is purely a contest, it is not included in the table below however click here for the Qtrade Financial Best of Canada Giveaway contest.

Update 3: Scotia iTrade has launched a new promotion/contest by offering 100 commission-free trades, 60 days of their FlightDesk and chances to win tickets to the Stanley Cup finals and secondary prizes of 16GB Apple iPad Airs. For new accounts with at least $15,000, individuals will be eligible to receive the free trades and ballots that will be entered into a draw for their grand prize as well as for the secondary prizes. As an incentive to gain additional deposits, Scotia iTrade is offering 5 ballots for every $5,000 on top of the original deposit amount that comes from a non-Scotia iTrade account. The good news for those interested in the contest is that there is no purchase necessary in order to enter – an entry into the contest can be made from the Scotia iTrade website. The terms & conditions along with the rules & regulations of this contest are over 2900 words (~8 pages) so there is quite a bit of material to get through to fully understand the offer. ]

Updated: Jan 2/2014 – Virtual Brokers has added a transfer fee deal in which they will cover up to $150 of the cost of transferring an account over to them (minimum deposit of $25,000)] There aren’t any new deals to report on as of Jan. 1st, however there are two deals that expire within the first week of January which means there may be some new deals to announce shortly. The deal of particular interest is BMO InvestorLine’s $250 cash back & 2 month commission-free trade offer which expires January 6th. As always if there are any new deals you hear of or if there’s any that have been missed, drop us a note here or in the comments section.

Discount Brokerage Deals

| Company |

Brief Description |

Minimum Deposit Amount |

Commission/Cash Offer Type |

Time Limit to Use Commission/Cash Offer |

Details Link |

Deadline |

|

A Sparx Trading exclusive offer! Use the promo code “Sparx Trading” when signing up for a new account with Jitney and receive access to their preferred pricing package and a massive 45% discount on the Real Tick trading platform. |

n/a |

Discounted Commission Rates |

none |

For more details click here |

none |

|

Open a new account with RBC Direct Investing before March 3, 2014 and they will offer 20 commission free trades that are good for use for up to 90 days. Use promo code: 20W17 when opening the account. Be sure to read the offer page and the terms and conditions page for full information. |

$0 |

20 free trades (equity & etf) |

90 days |

For the offer page, click here and for the terms and conditions, click here |

March 3, 2014 |

|

Open a new account (TFSA, Margin or RRSP) and receive $50 commission credit . Use promo code: kdkfnbbc |

$1,000 |

$50 commission credit |

none |

none |

none |

|

Open an account with Virtual Brokers with a deposit at least $1,000 and Virtual Brokers will offer 25 commission free trades which can be used for up to 1 year. Use promo code “25FTNE” when signing up. This offer is open to new clients only. Be sure to read the terms and conditions for full details on this offer. |

$1,000 |

25 commission-free trades |

365 days |

25 free trades offer |

March 31, 2014 |

|

Refer a friend to Questrade and when they open an account you receive $100 and they receive $50. To receive this deal you must be an existing client with an equity account and refer a person that does not reside with you and who has not previously opened a Questrade account. |

$1,000 |

$50 commission credit (friend) $100 commission credit (referrer bonus) |

60 days |

Refer a friend |

none |

|

Open a new account (TFSA, Margin or RRSP) by March 1 2014 A) $1000 or B) $10,000 to receive either A)10 commission-free trades or B)100 commission-free trades. The promo code QT100 must be used at time of account opening. There are many conditions attached to this offer so be sure to read the details link for more information. |

A)$1,000 B)$10,000 |

A)10 free trades B)100 free trades |

60 days |

100 commission-free trades |

March 1, 2014 |

|

Open a new TFSA, margin or registered account with Questrade and receive either A) 31 days B) 62 days or C) 90 days of unlimited commission-free stock & options trades. Use promo code UNLIMITEDW14 when signing up. Be sure to read the terms and conditions for more information. |

A)$1,000 B)$25,000 C)$50,000 |

Unlimited commission-free trades during associated period. |

A) 31 days B) 62 days C) 90 days |

Questrade Unlimited Trade Promo |

March 3, 2014 |

|

If you refer a friend/family member who is not already a Scotia iTrade account holder to them, both you and your friend get a bonus of either cash or free trades. You have to use the referral form to pass along your info as well as your friend/family members’ contact info in order to qualify. There are lots of details/conditions to this deal so be sure to read the details link. |

A)$10,000 B)$50,000+ |

A) You(referrer): $50 or 10 free trades; Your “Friend”: $50 or 10 free trades (max total value:$99.90) B) You(referrer): $100 cash or 50 free trades; Your “Friend”: $100 cash or 50 free trades (max total value: $499.50) |

60 days |

Refer A Friend to Scotia iTrade |

January 31, 2014 |

|

Deposit $5,000 into an RSP and $5,000 into either a cash or TFSA account and Credential Direct will waive the $50 administration fee for the RSP account. Be sure to contact their customer service to clarify the exact terms & conditions. |

$10,000 ($5000 into RSP + $5000 into TFSA/Cash account) |

$50 admin fee waived |

none |

5+5 Promotion |

March 3, 2014 |

|

Open a new account with Scotia iTrade and fund it with at least $15,000, and you can receive 100 commission-free trades, 60 days of FlightDesk and be entered into a contest for a trip to the Stanley Cup Finals or one of 5 runner-up prizes of iPad Air (64gb). Use Promo code RS13-SCE when opening the account. Existing clients must call customer service to qualify for contest entry. There are lots of terms, conditions, and rules/regulations so be sure to read them for more details. |

$15,000 |

100 free trades ($999 max value @ 9.99 commission rate) |

60 days |

Stake Your Claim to the Stanley Cup Promotion |

March 24, 2014 |

|

Transfer $15,000 from another institution into an HSBC InvestDirect account and receive 5 commission-free equity trades. This deal also offers a transfer-fee rebate of up to $150 per account transferred. |

$15,000 |

5 commission-free equity trades |

Trades valid for use until May 31, 2014 |

HSBC InvestDirect Transfer Fee Promo |

February 28, 2014 |

|

Open a new account before March 31, 2014 with at least a)$20,000 or b)$100,000 and National Bank Direct Brokerage will offer up to a)$500 or b)$1000 in commission fee credits. Use the promo code “CASHBACK2014” when signing up to qualify for this offer. Be sure to read the terms and conditions for this offer especially the refund dates for commission credits. |

A)$20,000 B)$100,000 |

A)$500 commission credit B)$1000 commission credit |

90 days |

Invest and get cash back offer |

March 31, 2014 |

|

Open and fund a new Scotia iTRADE account with at least $25,000 before March 31, 2014 and the commissions associated with your first 100 trades placed within 60 days of the date the account is activated and funded are free. Also, the new FlightDesk platform is being offered for free for 60 days. Use promo code 100FT. See details link for further terms and conditions. |

$25,000 |

100 commission-free trades ($999 value @ $9.99 commission rate) |

60 days |

Scotia iTrade 100 free trades + FlightDesk |

March 31, 2014 |

|

Open and fund a new account at CIBC Investor’s Edge with either A)$25,000 or B)$50,000 and receive either A)$200 + 25 free equity trades or B)$400 + 50 free equity trades. This is an in-branch promotion so contact either customer service or a branch for specific terms and conditions. |

A)$25,000 B)$50,000 |

A)$200 + 25 commission-free equity trades B)$400 + 50 commission-free equity trades |

1 year |

Must visit branch to qualify |

February 1, 2014 |

|

Open and fund a new RSP or TFSA account with BMO InvestorLine with either A)$25,000 or B)$50,000 and they will pay either A)$100 or B)$250 cash back. The promo code for the $100 cash back is “SELECTR100” and for the $250 cash back offer is “SELECTR250”. Be sure to read the terms & conditions for more information. |

A)$25,000 B)$50,000 |

A)$100 B)$250 |

Payout occurs after 6 months |

Registered Account Cross Sell Campaign |

March 31, 2014 |

|

Open and fund a new Cash, Margin, or RSP account with BMO InvestorLine with $25,000 or more and receive $88 cash back. The promo code for the $88 cash back offer is LUNAR2014. Be sure to read the terms & conditions for more information. |

$25,000 |

$88 |

Payout occurs after 3 months |

2014 Lunar New Year Promotion |

February 22, 2014 |

|

*Expired* Open a new account at Questrade by January 2, 2014 and fund it with a minimum of $25,000 to receive 25 commission-free trades which can be used throughout 2014. Use offer code BOXING13 when signing up for the account to qualify. Be sure to read the terms and conditions associated with this offer for more details. |

$25,000 |

25 commission-free trades |

End of 2014 |

Questrade Boxing Day Promo |

January 2, 2014 |

|

*Expired* Open and fund a new account with $25,000 or more and you will qualify for 25 free trades. The offer code changed with different visits to the site, so click through the RBC Direct Investing homepage to generate a valid code. There are a number of terms and conditions attached to this offer, be sure to read see the details link. |

$25,000 |

25 commission-free trades (no restriction on commission rate listed) |

365 days |

25 Free Trades Offer Terms & Conditions ; Link To generate an offer code no longer valid. |

none |

|

Disnat is offering new & existing clients $300 in commission credits which can be used for up to 6 months. To be eligible, new/existing clients need to deposit $50,000 into a Disnat account. You’ll have to call 1 800 268-8471 and mention promo code Disnat300. See details link for more info. |

$50,000 |

$300 commission credit |

6 months |

Disnat $300 Commission Credit Promo |

March 31, 2014 |

|

*Expired* Open a new account or upgrade an existing account with A) $50,000 or more OR B)$100,000 or more and receive either A)250 commission-free mobile-placed trades OR B) 250 commission-free mobile-placed trades + $250 cash back. Use Promo Code: MOBILE when signing up to qualify. NOTE: There are lots of details/important conditions attached to this promotion. Be sure to read the terms and conditions carefully. |

A) $50,000 B)$100,000 |

A) 250 commission free mobile-placed trades B) 250 commission free mobile-placed trades + $250 Cash Back |

Payout occurs after 6 months |

Free Mobile Trading/Cash Back Offer |

January 6, 2014 |

|

If you refer a new client to BMO InvestorLine and they open an account with a)$50,000 – $249,999 or b)$250,000+ the referrer and the referee will both receive cash. The new account must be opened with the referral code specific to the referrer. |

A) $50,000 – $249,000 B) $250,000+ |

A) You(referrer): $200; Your Friend(referee): $50 B) You(referrer): $300; Your Friend: $100 |

Payout occurs after 60 days (subject to conditions). |

Refer A Friend Terms & Conditions |

October 31, 2014 |

|

[Main offer]Open a new account or deposit new funds of $100,00 or more and you can be eligible for cash rebates of $250 and 250 commission-free trades (Promo code: RSP250). [Bonus Offer] If you open a new account or fund another account you could also be eligible for an additional $50 and 50 commission-free trades (Promo code ADD50). Be sure to read the full details & terms of this offer. |

$100,000 (main offer) $5000 (bonus offer) |

[main offer] $250 cash back + 250 commission-free trades (max value $2500) [Bonus offer] $50 + 50 commission-free trades |

90 days |

$300 + 300 trade offer |

March 10, 2014 |

|

Open a new account or transfer new assets of $100,000 or more and choose between receiving either a)A 16GB iPad Mini or B)$250 cash back. Be sure to choose the appropriate code (IPADMINIW13 for the iPad Mini and CASH250W13 for the cash back offer) for each offer. There are several important conditions so be sure to read the terms and conditions for this offer. |

$100,000 |

A) iPad Mini (16 GB) [~$270-320 value] B) $250 Cash |

Payout/iPad delivery occurs after 30 days. |

iPad Mini or $250 Cash Back |

March 1, 2014 |

Transfer Fee Deals

| Company |

Brief Description |

Maximum Transfer Fee Coverage Amount |

Deposit Amount for Transfer Fee Eligibility |

Details Link |

Deadline |

|

Transfer in $15,000 or more into an HSBC InvestDirect account from another institution, and HSBC will cover up to $150 of transfer fees per funded account. |

$150 |

$15,000 |

HSBC InvestDirect Transfer Fee Promo |

February 28, 2014 |

|

Transfer $15,000 or more to RBC Direct Investing and they will pay up to $135 in transfer fees |

$135 |

$15,000 |

Transfer Fee Rebate Details |

none |

|

Move your brokerage account to Questrade and they’ll cover the transfer-out fee up to $150. |

$150 |

$25,000 |

Transfer Fee Promo |

none |

|

Virtual Brokers will cover transfer fees from your transferring institution to a maximum of $150 per account. This offer is only applicable to accounts opened with at least $25,000 in equity before March 31, 2014 |

$150 |

$25,000 |

Transfer Fee Promo |

March 31, 2014 |

|

Transfer $25,000 or more to a National Bank Direct Brokerage account and they will pay up to $135 plus taxes in transfer fees |

$135 |

$25,000 |

Transfer Fee Rebate |

none |

|

Qtrade Investor will reimburse your transfer fee up to $125 when transferring a balance of $25,000 or more. For reimbursement, please mail or fax a copy of your statement from the transferring institution that shows the transfer charge to Qtrade Investor at 604.484.2627 and indicate your Qtrade Investor account number. |

$125 |

$25,000 |

Transfer Fee Promo |

none |

|

Disnat is offering up to $150 to cover the cost of transfer fees from another institution. To be eligible, new/existing clients need to deposit $50,000 into a Disnat account. You’ll have to call 1 800 268-8471 and mention promo code Disnat300. See details link for more info. |

$150 |

$50,000 |

Disnat $300 Commission Credit Promo |

March 31, 2014 |

Fortunately for self-directed investors, one Canadian research firm (Dalbar Canada) measures client experience for most of the Canadian discount brokerages as part of their direct brokerage service evaluation (DBSE) program. As part of the DBSE, Dalbar Canada also recognizes the high achievers in their evaluation with their Direct Brokerage Service Award.

Fortunately for self-directed investors, one Canadian research firm (Dalbar Canada) measures client experience for most of the Canadian discount brokerages as part of their direct brokerage service evaluation (DBSE) program. As part of the DBSE, Dalbar Canada also recognizes the high achievers in their evaluation with their Direct Brokerage Service Award. Staying on top of all of the discount brokerage action going on this January feels a bit like chasing either Russell Wilson or Colin Kaepernick around the field. The competition between these two elite quarterbacks pales in comparison, however, to that of Canadian brokerages.

Staying on top of all of the discount brokerage action going on this January feels a bit like chasing either Russell Wilson or Colin Kaepernick around the field. The competition between these two elite quarterbacks pales in comparison, however, to that of Canadian brokerages.

This week it was bone-chillingly cold everywhere in Canada except for the discount broker deal space (and maybe Vancouver). Several big promotions heated up the deals space this week in what is likely a sign of the fierce competition for self-directed investors’ assets to come this RSP deadline season. Just in time for all that were a couple of big announcements too. One from a discount broker lowering their commission fees and another from a discount brokerage customer service evaluation. Closing out the roundup, we’ll take a look at the investor forums for some valuable lessons for those venturing into wild west of online trading.

This week it was bone-chillingly cold everywhere in Canada except for the discount broker deal space (and maybe Vancouver). Several big promotions heated up the deals space this week in what is likely a sign of the fierce competition for self-directed investors’ assets to come this RSP deadline season. Just in time for all that were a couple of big announcements too. One from a discount broker lowering their commission fees and another from a discount brokerage customer service evaluation. Closing out the roundup, we’ll take a look at the investor forums for some valuable lessons for those venturing into wild west of online trading. In a related vein, this past week

In a related vein, this past week  [Updated: Jan 31/2014] *While we thought the beginning of January would be a busy time for deals, we didn’t know it would be THIS crazy. Since the beginning of the month there have been quite a few big announcements. Read below for more details* Welcome to the first discount brokerage deals post of 2014! 2013 was a great year for self-directed investors looking for deals & promotions when opening an online trading account. This past year the promos pitched from Canadian discount brokerages included:

[Updated: Jan 31/2014] *While we thought the beginning of January would be a busy time for deals, we didn’t know it would be THIS crazy. Since the beginning of the month there have been quite a few big announcements. Read below for more details* Welcome to the first discount brokerage deals post of 2014! 2013 was a great year for self-directed investors looking for deals & promotions when opening an online trading account. This past year the promos pitched from Canadian discount brokerages included:

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

With bargain hunters being bullish on all kinds of deals, this Black Friday edition of the weekly roundup will hopefully be enjoyed on the screens of some newly purchased electronic goodies. While the Black Friday madness has yet to hit the discount brokerage world (*yet*), there was still quite a bit of activity to report on. This past week another discount broker was crowned “best online brokerage”, there was a roll out of practice accounts from a major discount broker and low fee mutual funds start to pick up steam.

When the

When the  Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.