It’s hard to fathom, but May is already/finally here. For the superstitious market participants, it’s the month that investors tend to seek an exit (sell in May and go away). The data, however, paints a different picture to trying to time an exit – and interestingly enough, we’ve got data in spades this month.

In this edition of the Weekly Roundup, we launch into a new month with a quick update on the latest deals and promotions activity, and then take an ultra-deep dive into a huge report on DIY investing published by one of Canada’s most influential securities regulators. Given the length of this week’s Roundup, we’ll save reporting on the forum chatter for next week.

Discount Brokerage Deals Update for May

It’s the start of a new month, and that means our regularly scheduled check-in on the online brokerage deals landscape for Canadian DIY investors.

This month, online brokerage deals and promotions are effectively on cruise control, with no major offers launching or ending to begin the new month. That said, there are some interesting observations about the current status of deals and promotions, as well as some other interesting developments that point to activity “off Broadway” when it comes to how certain online brokers are approaching the deals and promotions space.

One of the first important observations for this spring is the paucity of cash-back offers. BMO InvestorLine is the only Canadian online brokerage offering a mass-market cash-back bonus promotion. In a world where the race between bank-owned online brokerages is as close as it is, BMO’s offer will undoubtedly boost their exposure for DIY investors looking for a big-bank option.

Instead of cash-back offers this spring, it appears that most other online brokers coming to market with a promotion are opting for commission-free trade bonuses. After the RSP contribution deadline, HSBC InvestDirect launched their commission free trade offer. Prior to that, National Bank Direct Brokerage also launched a sizeable commission-free trade promotion. Other online brokerages, such as Questrade, have maintained their commission credit promotions throughout the year with no signs that they are concluding.

The takeaway here seems to be that Canadian online brokerages are looking to control their costs by offering up commission-free trades, which while valuable to consumers, also cost less than cash-back promotions.

Interestingly, for one online brokerage that already offers commission-free trading, Wealthsimple Trade, cash back is the go-to option. We’ve noted that over the past few months there have been cash-back bonuses ranging from $50 to $100 for new clients of Wealthsimple Trade. These bonuses have been available through different affiliates that work with Wealthsimple Trade.

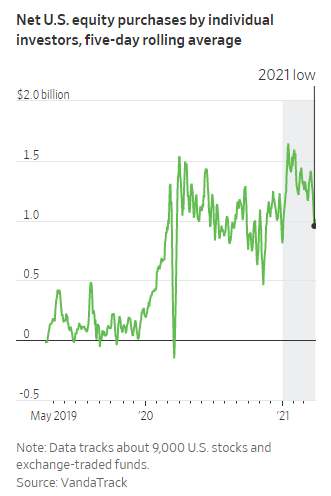

From a big picture perspective, data on the interest in retail investors signing up to open new accounts (a key target for online brokerages) shows that this traffic is slowing down.

While some stories, like cryptocurrencies, continue to generate interest and participation in trading online, stock markets are nowhere nearly as “cheap” or as volatile as they were a year ago. As a result, without the added catalyst of a contribution deadline looming, or significant market volatility, it appears that the speed and intensity of account openings will decrease.

What that means for deals and promotions throughout the rest of the spring and into summer, however, is that online brokerages who want to gain more attention and possibly market share have an opportunity to do so now before both the cost and complexity of doing so goes up in the fall – when the ramp up to next year’s RSP contribution season begins.

It is especially curious that given the important changes taking place in the industry – such as the recent rebrand of Qtrade, potential new entrants to the Canadian online brokerage space, and the rise in prominence of commission-free trading provider Wealthsimple Trade, that online brokerages are not more assertively coming to market with promotional offers.

Deals and discounts provide an opportunity to win the attention of DIY investors looking for a good fit for online brokerage services, and promotions – including commission-free trade promotions – enable DIY investors a low-risk route to try out the experience with an online brokerage. It’s a low-cost, win-win option, especially when the alternative for most Canadian online brokerages is to win the race to provide outstanding digital experiences faster than a commission-free brokerage can provide features investors want.

DIY Investor Deep Dive: Recent Study Provides Insights on Online Investors

Last month, the Ontario Securities Commission (OSC), which is the securities regulator in Ontario, released an in-depth study of retail investors in Canada in response to the rise in interest of online investing during the past year.

Clocking in at 59 pages (46 if you don’t count title slides), this report was a treasure trove of data that explored many facets of the online investing experience, and was organized into the following categories:

- The impact of the COVID-19 pandemic

- Products and performance

- Reasons for being self-directed

- Risk preferences

- Markets and order types

- Information used to determine investments and trading decisions

- Time spent investing

- Tools, features, and apps

With so much data to dig into, there’s a lot to digest about the online investor space in Canada, especially as it relates to attributes about DIY investors. That said, there are a few key areas of interest that warrant mentioning in the Roundup, given the impact to the online brokerage space in Canada.

Methodology

Before diving into some of the more noteworthy findings of the report, it is useful and appropriate to highlight the methodology and background of the study to appreciate just how valuable the data is that was collected and released.

The OSC self-directed investor report studied 2,000 Canadian investors using an online poll administered by research firm Leger, between November 17 and December 6, 2020. To qualify for the survey, individuals had to identify as a self-directed investor for one of their accounts, and they were required to have at least one of a series of investment products, such as individual stocks, ETFs or REITs, bonds, mutual funds, or other types of securities or derivatives.

While the report disclosed standard demographics like gender, age, and geography, it also reported interesting parameters such as the value of DIY investments (which 85% of respondents disclosed). With a concentration of focus in Ontario (43%), and skewing male (60%) there is clearly an overrepresentation in the data towards the behaviour and perspectives of a sub-group of Canadian DIY investors.

Another important note to keep in mind is that this report stated that it would have a margin of error of +/- 2%, 19 times out of 20, based on its sample of 2,000 respondents. Why that is particularly relevant will become clear in diving into some of the data that was reported, and how the data from this study stacks up against reports of the online investing space over the past year from other sources.

The “Rise” of DIY Investing

The first major finding of this survey is perhaps its most controversial: that “10% of investors opened their self-directed account during the pandemic.”

Looking closely at the data underlying that claim, 10% of respondents claimed to have had their direct investing account for less than nine months. Compared against the number of respondents (9%) that claimed to have had their accounts for between 9 months and one year, the number of survey respondents that actually opened an account during the pandemic seems shockingly low.

A report by the Investment Industry Regulatory Organization of Canada (IIROC) in February of this year cited a statistic from financial research firm Investor Economics that showed there were more than 2.3 million online brokerage accounts opened in 2020 (from January to December) compared to 846,000 in the same period in 2019.

The 170% increase in account opens reported by Investor Economics implies that the sample taken by the OSC study does not materially reflect the actual percentage of investors who opened an online brokerage account for the first time between March and December. As a result, the first claim should probably be restated as:

“10% of the investors who participated in this survey opened their self-directed account during the pandemic”

Interestingly, this more accurate phrasing was part of the OSC report’s press release in one place, but not in others, and as such could be misleading to readers trying to understand what online brokerages, investors, and other research studies have indicated as a historic year in online investing.

That important caveat about who this data actually represents in mind, this report did provide an extensive view into an important collection of online investor attributes, behaviours, and perceptions that is worth reading through.

DIY Investors Enjoy It

One of the more fascinating findings of this survey was that of the underlying motivation to being a DIY investor.

When queried as to why they do not use an advisor to manage their investments, it was surprising to see that 44% of respondents stated that they enjoyed managing their investments. The next most popular answer was that 34% found that having an advisor manage their investments was too expensive.

The responses provided shed light on a narrative that doesn’t get nearly enough attention in the world of online investing – that individual DIY investors enjoy managing their own investments. It is important to note, however, that alongside the average (44%) there were additional attributes that helped to make a more nuanced assessment of the response data.

For example, there was clearly a significant preference for respondents whose household investments were greater than $500K, compared to respondents with lower amounts of investments. Specifically, 64% of respondents whose investments exceeded $500K stated they enjoy managing their own investments, compared to 39% for those that had less than $100K, and 45% for those who had between $100K and $500K.

Another interesting contextual piece is that there was a significant relationship between individuals who reported enjoying managing their own investments and their self-perceived knowledge of investing. 56% of individuals who reported having a high perceived knowledge of investing reported that they enjoyed managing their own investments, compared to only 22% of respondents who had low self-perceived knowledge.

The key takeaways here are that the more money you have and the more you believe in your understanding of investments, the more it seems you like to be a DIY investor.

With so much focus on commission price when it comes to selecting an online brokerage, it was equally fascinating to see the data pattern emerge from respondents when it came to perceptions of value for management of investments. Stating that something is “too expensive” could be in reference to many things, but what was fascinating to note was that regardless of the perceived knowledge or the amount of household investment, between 33% and 40% of respondents agreed that the price of advice was too high. Though it was not deemed statistically significant, it was nonetheless intriguing to see that more household investments a respondent had, the more likely they were to see advice as too expensive.

Although it might not have scored as the primary motivating factor in this sample of DIY investors, the level of agreement between investors of different knowledge levels and asset levels that advisors are “too expensive” reflects one of the strongest value propositions for online brokerages: perceived value matters.

Again, coming back to the fact that 80% of the respondents of this survey have had their DIY investing accounts for more than a year, the fact that just about one third of DIY investors in the survey had price as a key driver implies that there is a very big segment of online investors who are prepared to do the work required to manage their own finances, including some of them who don’t believe they can get a better return themselves.

Perceived Knowledge: The Double-Edged Sword

At its core, all investing is speculative. When investors claim to have a high degree of perceived knowledge about investing, the term “knowledge” could mean different things to different people. Of course, feeling like you know, as it turns out, could have a huge impact on whether or not you enjoy DIY investing.

Another interesting data point to emerge from this survey is that 69% of respondents reported feeling satisfied with their experience overall as an investor (20% report being very satisfied and 49% reported being somewhat satisfied). Any reader of social media comments about online brokerages over the past year would probably have a different view of this data. This serves to illustrate that what conclusions you can draw about the industry or the endeavour of investing online depends heavily on who you ask, and where those investors are sourced.

The contextual information alongside the percent satisfaction illustrates an interesting pattern that shows the greater the size of investments ($500K or over) and the higher the perceived knowledge, the more likely an investor will be satisfied with their experience as a DIY investor. This was the same data pattern observed in asking why DIY investors did not want to go with a financial advisor. The number that really jumps out is the difference in satisfaction between individuals with high perceived knowledge (84% of them claimed to be satisfied), versus those with low perceived knowledge (37%). Clearly, if online brokerages can address the perceived knowledge gap, there’s reason to believe that satisfaction will improve.

Of course, a little bit of knowledge can be a dangerous thing, and another fascinating data point to emerge was when respondents were challenged to answer five skill-testing questions about marketplaces and orders.

Shockingly, none of the 2,000 investors polled answered all five of the questions right, and only 4% got four of five questions right.

Perhaps even more shocking (and a touch ironic), even the survey authors made a mistake on the name of a major stock exchange in Canada, the Canadian Securities Exchange (CSE). It begs the question: if regulators and survey creators can get this stuff wrong, what hope do DIY investors have?

It is fascinating to see that 13% of individuals who self-identified as having high perceived knowledge of investing thought that Wealthsimple Trade, which was used as a decoy option, was a real stock exchange. The lack of investor awareness of the different securities exchanges in Canada, as well as where stocks can be traded, highlights a gap in understanding of some of the basic information that would be material to an investor, like where to go to find more information about a security they invested in, or what happens to an order if the exchange experiences an outage.

The fact that respondents could score so poorly on questions about the mechanics of trading online, while at the same time rate their satisfaction with being an online investor so highly, implies that much of the process of online investing itself is disconnected from really having to understand some basic (but important) information about the assets being traded. Ironically (again) this was brought up just this past week by investing sage Warren Buffet who implied that online brokerages, in particular those like Robinhood with a focus on younger investors (and who saw a massive surge in new accounts during the pandemic), are catering towards the gambling instincts of investors.

Key Takeaways

There’s a lot in the latest OSC report on DIY investors in Canada that didn’t get covered or explored in this week’s Roundup. What was clear, however, is that there is a lot of valuable information that was published about a certain segment of DIY investors that were polled by the survey conducted.

One important (perhaps clear) takeaway is that it is important to carefully qualify the limitations of the data of any study or survey when it comes to making broad statements about the full population of DIY investors in Canada. The insights provided by this report appear to heavily describe investors who have been at investing for at least a year and are largely centered in Ontario. Ultimately, anyone hoping to get more insight into the Canadian DIY investor space learned some very interesting things from this report.

Perhaps the biggest point of interest is that the experience of online investing is one that is not only driven by price, which tends to dominate the narrative. Instead, there are clearly very human features – like enjoying the process – that comprise a significant part of why people choose to invest online as a DIY investor.

Where both industry and regulatory associations might be able to improve the experience is clearly in investor education. Not only in terms of understanding more about investing, but also when it comes to the important and often overlooked details of marketplaces and operational issues (including things like taxes) that DIY investors either don’t pay attention to, or aren’t being provided sufficient resources on.

Finally, it would be great to see reporting like this done at a regular cadence so that changes over time could be tracked and understood. There are numerous stakeholders that could benefit from this data, and it’s great that the OSC was able to publish this data set, but tracking these trends requires ongoing data capture. Just like watching a portfolio requires taking a long-term approach, there are now more DIY investors than ever, and tracking what shapes their experience over time is going to be perennially important to understand.

Into the Close

That’s a wrap on this data-intensive version of the Roundup. The good news for online brokerage industry nerds/enthusiasts is that there are a few more data reports that we didn’t get a chance to dive into this week, so be on the lookout next week for even more data insights. Now that May is upon us, it feels entirely appropriate to end with a strong meme! Stay safe!