This past week heralded the strangest and rarest of events. No, it wasn’t the solar eclipse or an upset in the NCAA basketball tournament; it was actually the arrival of Spring – in theory. It was fitting that the lead up into Spring saw a celebration of green for St. Paddy’s day at the beginning of the week and having the markets have a green day to end off the week. The shamrocks and markets weren’t the only green making waves this week, however, as a few ‘green’ discount brokerages were also busy making headlines.

This past week heralded the strangest and rarest of events. No, it wasn’t the solar eclipse or an upset in the NCAA basketball tournament; it was actually the arrival of Spring – in theory. It was fitting that the lead up into Spring saw a celebration of green for St. Paddy’s day at the beginning of the week and having the markets have a green day to end off the week. The shamrocks and markets weren’t the only green making waves this week, however, as a few ‘green’ discount brokerages were also busy making headlines.

In this week’s roundup, we start by looking at where discount brokerages are stepping up their game 140 characters at a time. Next we take a look at an article about Canadian brokerages and investors with commitment issues – just in time for wedding season. Of course, we’ve got another deal update to add to the list after which we’ll take a look at the upcoming investor education events and close out with a look across the investor forums.

#SocialMediaMatters

As we reported several weeks ago, the social media presence of Canadian discount brokerages has started to ratchet up. Credential Direct and TD Direct Investing have stepped into Twitter in a noticeable way, joining Questrade, Scotia iTrade and Virtual Brokers.

This past week, however, discount brokerages on Twitter showed yet again that they’re evolving quickly to understand how this medium works and how to be relevant in an increasingly busy online medium.

Both ‘big green’ (TD Direct Investing) and little green (Questrade) were spotted getting some major attention from online DIY investors.

Starting first with Questrade and their “What Are You Investing For” contest. Looking at the number and types of responses that Questrade received from the Twittersphere, this recent promotion signals that people are paying attention to Questrade in a major way. Of course, for their part, Questrade made it compelling by offering up the prize of an Asus tablet so naturally one might expect more interest than if Questrade simply asked the question without the possibility of a prize. One thing that does stand out, however, is that other brokerages aren’t (yet) doing the same thing. In fact, when it comes to social media (including forums), there are few corners where Questrade does not have a presence (their career team is even on Instagram).

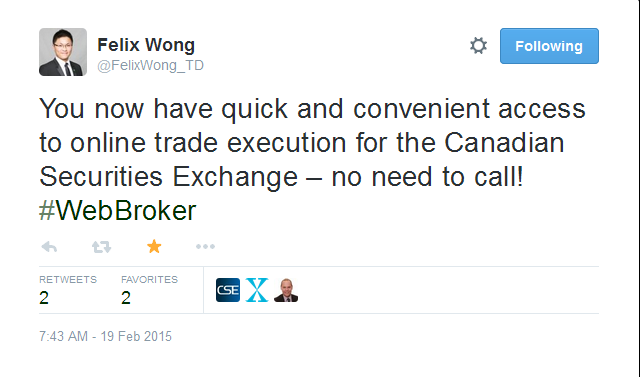

Another interesting angle in the brewing social media battle can be seen with activity this past week from TD Direct Investing. Specifically, the power of reach. Although TD Bank has a massive following on Twitter, TD Direct Investing does not have it’s own central account from which it tweets. Instead, it has taken the rather unique approach of mobilizing a wide number of its employees to start broadcasting TD Direct Investing content. This past week, TD Direct Investing held an investor education webinar on swing trading and landed a rather large crowd interested in the topic – almost 8,000 folks. While close to 300 attended the live event, what was interesting were the tweets leading up to, during and after the event. There were interesting/pun-laden graphics ahead of the event, lots of TD folks tweeting about it, lots of people talking about and compliments dished out after it.

The big questions for most DIY investors comes back down to ‘so what?’ What does it matter if a brokerage is on Twitter or not?

In the case of all the discount brokerages currently on Twitter, they understand that responding to people on the social media channels provides a different kind of convenience and a transparent service that takes time to get right. For younger or more tech savvy users, Twitter is a great way to connect directly with a service provider to get an answer to a query or resolve an issue without having to stray far from a news feed or to use another screen (or, God forbid, the phone).

For DIY investors, whether or not they’re clients of a particular brokerage, the content being pushed out by these brokerages is free and accessible. In the case of TD Direct Investing, finding out about these kinds of educational events via Twitter can help investors informed in a way that traditional media or Google news don’t quite do. There’s also a whole other kind of research on client service that is possible now that was never really accessible to investors. Seeing how each brokerage handles itself in the face of complaints or accolades is how consumers make their judgements.

While it might have taken some time for TD Direct Investing to get on board the #HashtagTrain, now that they are actively creating a presence for themselves, the brokerages already on Twitter will now have to (once again) step up their game. Those brokerages not on social media (and those on ‘autopilot’) have a real challenge ahead to step up. For DIY investors, that kind of competition between brokerages is likely to result in a whole new level of content and creativity which will probably be worth tuning into, at least for a fleeting moment or two.

House of (Prepaid) Cards

Questrade has launched yet another promotion into its suite of current offers. On the heels of the expired iPad mini promotion, Questrade has revived and slightly tweaked their prepaid Visa card promotional offer. In their current offer there are now four gift card denominations (ranging from $50 to $250) that are associated with four tiers of deposit amounts ranging from $5,000 to $100,000. While deposits are required in order to be eligible, it is also interesting to note that clients are also required to make at least one commission-generating trade in order to qualify for the gift card. Thus, while the face value of the gift card is $50, $75, $100 or $250, be sure to factor in the value of a commission-generating trade which can be anywhere from $4.95 to $9.95 (plus applicable fees). Click for more details on Questrade’s most recent promotion and other online brokerage deals.

Mind the Exit

One of the considerations when choosing an online brokerage is what happens if or when things don’t quite work out. While most Canadian discount brokerages do impose a ‘transfer out’ fee for clients who ask to have their account transferred to another entity, ironically most brokerages are also willing to pay the transfer fee (of between $135 – $150) for clients transferring money into a new account. Those most impacted by the transfer fees are individuals with less than $15,000 to $25,000, since these are typical deposit thresholds that individuals must be transferring into a new institution in order to qualify for a transfer fee rebate.

In a recent article (available to paid subscribers) by Globe and Mail personal finance columnist and leading voice on Canadian online brokerages, Rob Carrick, he discusses some of the important considerations about transfer fees that individuals should keep in mind when shopping for an online trading account.

One of the interesting points of the article was that if there is the opportunity to test drive a brokerage account via a free trial, it would offer a better idea of the platform and user experience of navigating the broker’s online interface.

Event Horizon

March 21:

Scotia iTRADE – Top Global Investment Themes for 2015 – Larry Berman Roadshow Niagara Falls, ON

March 24:

TD Direct Investing – Stock Talk

Scotia iTRADE – Options Trading For Beginners with Sarah Potter

TD Direct Investing – Introduction to Investing in Options

TD Direct Investing – Understanding Margin & Short Selling

March 25:

Desjardins Online Brokerage (Disnat) – Trading ETFs with Desjardins Online Brokerage

Scotia iTRADE – Options As A Hedging Strategy Using Call Options with Montreal Exchange

March 26:

TD Direct Investing – Evolution of Indexing

TD Direct Investing – Introduction to Investing in Options

From the Forums:

TD Waterhouse RRSP

Finding the right kind of account to get access to popular investment products is something that can be a tad confusing. In this post on RedFlagDeals’ investing forum, one user gets a little help from the community when wondering how best to start off with a modest RRSP.

To BMO or not to BMO

Sitting on the fence about a brokerage is a common moment for many DIY investors. In this post from the Canadian Money Forum, one new investor is looking to map out a path through mutual funds and ETFs and is wondering if BMO InvestorLine is the right option. Check out the perspective of the other investors when it came to staying on board or jumping ship.

Drip by Drip

Slow and steady wins the race. Using dividends to build wealth over time is a tested strategy that many DIY investors buy into. In this post from Canadian Money Forum, one user wants to know a bit more detail about using DRIPs at Canadian discount brokerages.

That’s it for this week’s roundup. To cap off the ‘social media’ theme, here is a great story of how spreading the message #OdinBirthday on social media gave one 13 year-old boy an awesome way to start the weekend and a birthday to remember. Enjoy the weekend!

Edited March 21/15

With daylight savings coming to an end, it’s time to spring forward. Time is definitely on the minds of many this weekend as we let our smart devices put our microwaves and wall clocks to shame by self-updating, but also because of Apple’s big iWatch reveal on Monday. Speaking of time, Canadian discount brokerages now have a bit more of it with RSP season now in the rear-view mirror. The break won’t last too long, however, with tax season gearing up, we think Canadian discount brokerages will also be looking to roll out some big announcements of their own very soon too.

With daylight savings coming to an end, it’s time to spring forward. Time is definitely on the minds of many this weekend as we let our smart devices put our microwaves and wall clocks to shame by self-updating, but also because of Apple’s big iWatch reveal on Monday. Speaking of time, Canadian discount brokerages now have a bit more of it with RSP season now in the rear-view mirror. The break won’t last too long, however, with tax season gearing up, we think Canadian discount brokerages will also be looking to roll out some big announcements of their own very soon too.

If Friday the 13th was supposed to be an unlucky day, somebody forgot to tell stock markets. Heading into Valentine’s Day weekend bullish investors saw fifty shades of green as they pushed markets to a record high close, yet again. Fittingly, Canadian discount brokerages were also out looking for love from DIY investors offering up just about everything but flowers and chocolate.

If Friday the 13th was supposed to be an unlucky day, somebody forgot to tell stock markets. Heading into Valentine’s Day weekend bullish investors saw fifty shades of green as they pushed markets to a record high close, yet again. Fittingly, Canadian discount brokerages were also out looking for love from DIY investors offering up just about everything but flowers and chocolate.

Canadian discount brokerages are hitting February at full speed. With a slew of deals, events and the roll out of new features it doesn’t appear like very much will be slowing down the activity at Canada’s brokerages.

Canadian discount brokerages are hitting February at full speed. With a slew of deals, events and the roll out of new features it doesn’t appear like very much will be slowing down the activity at Canada’s brokerages.

It looks like football players aren’t the only ones trying to score big this weekend. Burgers, fries and Candadian discount brokerages are also in the mix. With the frenzy of offers rounding out January, we’re heading into February with over 22 deals and promotions for anyone looking to open up an online trading account. That’s plenty to chew on.

It looks like football players aren’t the only ones trying to score big this weekend. Burgers, fries and Candadian discount brokerages are also in the mix. With the frenzy of offers rounding out January, we’re heading into February with over 22 deals and promotions for anyone looking to open up an online trading account. That’s plenty to chew on.