Happy New Year and welcome to 2022! The start of a new calendar year is typically the time of year when we all struggle with writing the correct year for a few weeks and then eventually get the hang of (or accept) being in a new place. Ironically, time distortion is a hallmark of a pandemic, and aside from not knowing what day of the week it is (every day is sweatpants day!), it seems that timing was topsy-turvy at online brokerages in Canada and the US. But this is the definition of the new normal, and like markets tend to do, we’re embracing the ability to adapt with the times.

Change is a big theme in this mega-edition of the Roundup. First, we dive into the biggest review of Canadian online brokerages: the Look Back / Look Ahead for 2021/2022. This in-depth look at the latest issue picks out some important themes that impacted Canadian online brokerages and self-directed investors in 2021 and what’s in store for 2022. Next, we recap the year with memes & themes in an epic rundown of the big (and small) stories of 2021. So, in case you missed the past year or simply just need a quick(ish) primer on what happened with Canadian online brokerages in 2021, be sure to read through this ultimate roundup of Roundups. Finally, be sure to get to the end for an important announcement on the schedule changes to the Roundup coming this January.

Online Brokerages Review 2021 & Offer Exclusive Preview of 2022

When given the opportunity and spotlight to speak directly to online investors, what did Canadian online brokerages have to say about an exceptional year and how to build on top of that?

Well, we found out just that in the latest edition of the Look Back / Look Ahead series in which Canadian online brokerage leaders shared their perspectives on the past year, as well as what they have planned for the year ahead.

This year’s edition featured submissions from BMO InvestorLine, Desjardins Online Brokerage, HSBC InvestDirect, National Bank Direct Brokerage, Qtrade Direct Investing and RBC Direct Investing, with senior leaders from each of these firms, sharing unique and intriguing perspectives into how various factors over the past year have influenced the priorities and direction of their respective firms going forward.

On a thematic level, it was clear that one of the biggest challenges and opportunities for the online brokerage industry in Canada was the meteoric rise of retail investor interest in trading stocks online. The stats provided were incredible. Desjardins Online Brokerage, for example, shared that 30% of their user base is between the ages of 18 and 30, and BMO InvestorLine reported nearly 50% of their new clients are under 35. And they’re likely not alone. The huge demographic shift in clients means that online brokerages are working to deliver features and experiences that align more closely with this group – including investor education resources.

Having covered the online brokerage industry in Canada for the past decade, an important theme of this issue we’ve witnessed is effort into investor education gradually recede. When Sparx Trading first launched, at least half a dozen or more online brokerages would regularly hold investor education seminars, webinars, or education-focused events. Gradually, however, as markets moved steadily higher and volatility subsided, interest in education waned, and whether it was supply or demand driven, “investor education” resources began to disappear.

Fast forward to today and it seems we are experiencing a renaissance of investor education based on the feedback from online brokerages, as well as in several of the trends we’ve been tracking throughout the industry. National Bank Direct Brokerage, for example, highlighted the fact they offer Options Play for free to their clients. This digital tool enables clients to simulate and learn about options trading strategies – something that is of growing interest to younger investors, especially coming out of the meme-stock craze of early 2021. At RBC Direct Investing, education is also on the roadmap for 2022 as is building out additional content for investors via the Inspired Investor magazine. And, at the industry giant TD Direct Investing, it is clear that investor-focused content will play an important role given their sizeable investment in building an entire content team that is likely going to be producing content at an unmatched volume.

Of course, the big story for 2021 in the Canadian online brokerage industry was the launch of commission-free trading by National Bank Direct Brokerage in August. Undeniably a surprise for many, the fact that a bank-owned online brokerage with a national footprint would be the first to offer full commission-free trading changed the competitive landscape for larger and smaller players alike. Not long after NBDB lowered their fees, Desjardins Online Brokerage followed suit. With both of these Quebec-based institutions taking trading commissions to zero, clearly commission-free trading is on the minds of self-directed investors and online brokerages alike. When polled about the issue, Canadian online brokerages revealed that they are clearly aware of it and would be looking to enhance value for investors with new features and offers rather than lower prices for trading commissions – at least at this point.

As we round the turn into 2022, however, zero-commission trading looms large. Just ahead of the end of 2021, Mogo Trade announced it had received the official green light to launch its commission-free trading app, and in our special section on commission-free online brokerages, we listed a total of four (including Mogo Trade) that we are currently tracking that are likely to come online either in 2022 or 2023. So, the reality for Canadian online brokerages is that zero-commission trading is coming, as is more competition.

Given the pace of innovation and change that are on the horizon, the Look Back / Look Ahead series provides visibility on which Canadian online brokerages are actively innovating, which firms are working on important infrastructure components, such as client experience, and which firms are clearly capable of doing both.

For self-directed investors, moving from online brokerage to online brokerage is (at least for now) a slow and painful exercise. Consumers would much rather stay where they are; however, without confidence in their online brokerage’s ability to innovate or be competitive on cost or value, alternatives are increasingly present.

Perhaps one of the most compelling stories in 2022 beyond commission-free trading will be a new feature telegraphed in the Look Back / Look Ahead from National Bank Direct Brokerage: paid securities lending.

In addition to offering zero-commission trading, the fact that clients could be compensated for lending their securities out to those seeking to short them lays a strategic foundation for NBDB to not only hang on to clients in a way that other brokerages are not (at least not yet), but it also is a draw for active traders who are looking to source shares for shorting. It’s a feature that currently exists only at Interactive Brokers, which is a signal or validation that active investors are either direct or indirect benefactors of this program. In short (pun intended), our call on National Bank Direct Brokerage in early 2021 appears to continue to play out: they are increasingly going to be an online brokerage to watch as they expand their presence across Canada. Until another major online brokerage in Canada drops their commission pricing to zero or close to it, National Bank Direct Brokerage is going to continue to be a top contender among self-directed investors looking to for a value-oriented online trading experience. Unlike other providers, however, NBDB isn’t waiting around for that to happen – they are clearly positioning themselves well with Options Play and the paid securities lending feature to be an attractive destination for active investors, as well as passive ones, and they’re working towards launching a mobile app which would only deepen the appeal with younger investors.

With 2021 now officially in the books, the Look Back / Look Ahead series is a great opportunity to get a unique perspective from industry insiders on the world of self-directed investing. As it falls on the tenth official year of the launch of SparxTrading.com, it also represents a significant milestone to have been covering the activity in this space to the depth and consistency that we have. Over the course of the decade, it’s been amazing to connect with industry analysts, online brokerage leaders, and self-directed investors to chat all things online investing. Most fulfilling, however, has been getting to be able to level the playing field for DIY investors and help, even in some small measure, make self-directed investing easier and more accessible.

True to the spirit of the Look Back / Look Ahead series, we also took the opportunity to announce the launch of Sparx Trading Pro. While it is still in development, we’re excited to be building something special for the community of users that regularly turn to SparxTrading.com for in-depth insight and analysis of the online brokerage industry. We love analytics and numbers, so a big part of what we hope to introduce is more data on what self-directed investors are interested in, and as a result, help serve as a catalyst to drive innovation.

Finally, on behalf of the entire Sparx Publishing Group organization and SparxTrading.com team, thank you to our loyal readers, visitors, and supporters. We’re amazed that 10 years has flown by, and we’re bullish on where the next chapter in self-directed investing goes from here. Thanks for tuning in!

Themes and Memes: Online Brokerage Highlights from Q2 2021 onwards

April: In with the New

From Qtrade’s new look and new name (Qtrade Direct Investing) to the preview of long sought-after features from Questrade and Wealthsimple Trade, April showered self-directed investors with the promise of new things to come.

The launch of the new brand direction for Qtrade Direct Investing was a huge milestone for this popular Canadian online brokerage. Executing a rebrand is no small feat; however, Qtrade managed to strike the right balance between a connection to what people know it for (i.e. its first name) and what it wants people to know it for. With a bold, new look and energy, it felt like Qtrade was ready to embrace the new landscape of online investing and bring something emotion into what has typically been a conservative brand.

Also looking to stir up some excitement, Questrade telegraphed the launch of a new mobile app – something that they hoped would help them compete more effectively against a design-savvy, mobile-first competitor: Wealthsimple Trade. It wouldn’t actually launch until November (see below) but the hype train on the new mobile app officially pulled out of the station in April.

And speaking of Wealthsimple Trade, new feature releases were a regular occurrence throughout the year, but one big announcement from the zero-commission brokerage was the news that they would be launching US dollar trading accounts. Long the Achilles heel for this very popular brokerage, the final form of the US dollar trading offering from Wealthsimple Trade ended up launching in December (see below).

May: Statistics and Outliers

Strange, almost by definition, is not normal. For the (fellow) statistics nerds out there, data is a great way to get a handle on what is considered normal and what’s an outlier. This month happened to be filled with DIY investor data from all over the world.

One of the big developments was the online brokerage ranking by Surviscor, which put online brokerage fees into the spotlight. Remarkably, even before going to zero commissions, National Bank Direct Brokerage took the crown of lowest cost provider which is no small feat in a fiercely price sensitive industry.

Another watershed pricing moment came later in the month from popular bank-owned online brokerage BMO InvestorLine. In a calculated move, BMO InvestorLine launched 80 commission-free ETFs, and while they are not the only Canadian online brokerage to offer completely commission-free ETF buying and selling, the move gave both active and passive investors a compelling reason to choose this online brokerage over others (especially bank-owned brokerage competitors).

June: More New Features

Summer is typically the time for big blockbuster movies. Although the silver screens weren’t as busy this past year, DIY investor screens were filled with blockbuster reveals in the summer.

Perhaps the biggest one for Canadian self-directed investors (up until that point) was the launch of fractional share trading by Wealthsimple Trade. This highly-prized feature is something that US online investors were able to have access to from a variety of online brokerages, but for mainstream investors in Canada, Wealthsimple Trade was able to make a huge splash by bringing this trading to the masses in Canada.

The huge news from Wealthsimple Trade essentially overshadowed a lot of other new and newsworthy feature releases that month, including the launch of faster deposit times for Questrade, new advanced trading tools for clients of RBC Direct Investing, and the launch of the Interactive Brokers credit card in Canada.

July: No Strings Attached

The Robinhood IPO and the opportunity to “buy buy buy” into the game-changing commission-free online brokerage was undeniably one of the biggest stories in the space this past year. By venturing into the public markets, it was possible to look under the financial “hood” to see how this commission-free brokerage managed to grow so rapidly, and, more importantly, how they made their money despite keeping commissions at zero. As it turned out, the prospectus for Robinhood’s IPO made for some fascinating reading.

No stranger to life as a publicly traded online brokerage, however, Interactive Brokers managed to pull off a deft mic drop moment of their own when they waved bye-bye-bye to inactivity fees for their clients worldwide. This included Canadian online investors, so it was a huge win for DIY investors everywhere who, prior to the removal of inactivity fees, were reluctant to have more than their most active accounts with Interactive Brokers. By lowering the friction to stay a customer of Interactive Brokers, this savvy online brokerage turned the math of customer churn on its head and managed to find a way to get customers to stay, even if they needed to step back from active trading for a while.

August: Coming This Fall

Twenty twenty-one was many things, but typical it was not. For that reason, we probably should have known better than to think it would be business as usual – or more appropriately – quiet business as usual. August happened to be an historic month for Canadian online investors because that was the month National Bank Direct Brokerage chose to launch commission-free trading.

Not only did National Bank Direct Brokerage take their commission fees for trading stocks to zero, they simultaneously took the vacation plans for other online brokerage leaders to zero as well.

And, while there wasn’t a story bigger than that, there was one that came close. We spotted and reported on the potential launch of yet another commission-free online broker, FreeTrade, here in Canada. In addition to Mogo Trade, FreeTrade represented yet another online brokerage interested in launching direct trading services in Canada with no commission.

Between the news of National Bank Direct Brokerage and the potential launch of another commission-free online brokerage in Canada, a clear trend is forming, and now it seems only a matter of time before existing big-bank online brokerages follow suit with significant commission rate drops.

September: Adding Up

We had to do a double take when it came to turning double digits. September marked 10 years since SparxTrading.com launched with a mission to level the playing field for online investors and “discount brokerages” as they were then known.

It has been a spectacular journey, and despite a very different landscape for online investors today, it was clear that a resource like Sparx Trading is needed as much now as it was when we first started. We also recognized that to prepare for a very dynamic future in the online brokerage space, we had to make some big changes – starting with a full redesign on the website, and in September, we also added the ability for online investors to research what other people are saying about online brokerages on Twitter and reddit, two areas which saw huge gains in participation by retail investors.

We weren’t the only ones launching a retail investor sentiment tool, however. As it turned out, TD Direct Investing launched the TD Direct Investing Index to measure Canadian investor sentiment in the stock market. With several Canadian online brokerages regularly reporting what their clients have been trading, this new feature from TDDI takes things to a whole new level by providing data on demographics and location, as well as sectors.

Of course, when it comes to online investors in 2021, stocks weren’t the only asset class of interest to them. In a stunning pivot (and/or a capitulation to giving people what they want), Interactive Brokers announced they would be enabling cryptocurrency trading to their clients. The big story here is that founder and very public face of Interactive Brokers, Thomas Peterffy, has been an outspoken critic of cryptocurrency for years, and so to see him personally acknowledge the material relevance of cryptocurrency as well as make the feature available to Interactive Brokers clients underscores the trading adage of “not fighting the tape.” Demand for cryptocurrency trading was simply too high despite the potential regulatory peril it could represent. Interactive Brokers was by no means the only big name in the US to adopt or support cryptocurrency trading, but it does signal that there is a sufficiently high level of interest among new and experienced investors in trading this digital asset class.

October: And Another One

And speaking of listening to customers, the launch of the QuestMobile app by Questrade generated a tonne (yes, it felt like the metric kind) of responses from clients and observers who weighed in (pun intended) on the new feature. There are only a handful of examples of feature launches from online brokerages over the past decade that generated so much response online, and the QuestMobile launch ranks high on the list of lightning rod discussion points.

Questrade’s unique success online with DIY investors ultimately became its undoing in this case because so many of its clients were not shy about providing their (negative) feedback on social media and investor forums. Regardless of the merits of the app, the roll-out of a new interface is a highly instructive case study change management, especially in an era of increasingly tech and design savvy clientele.

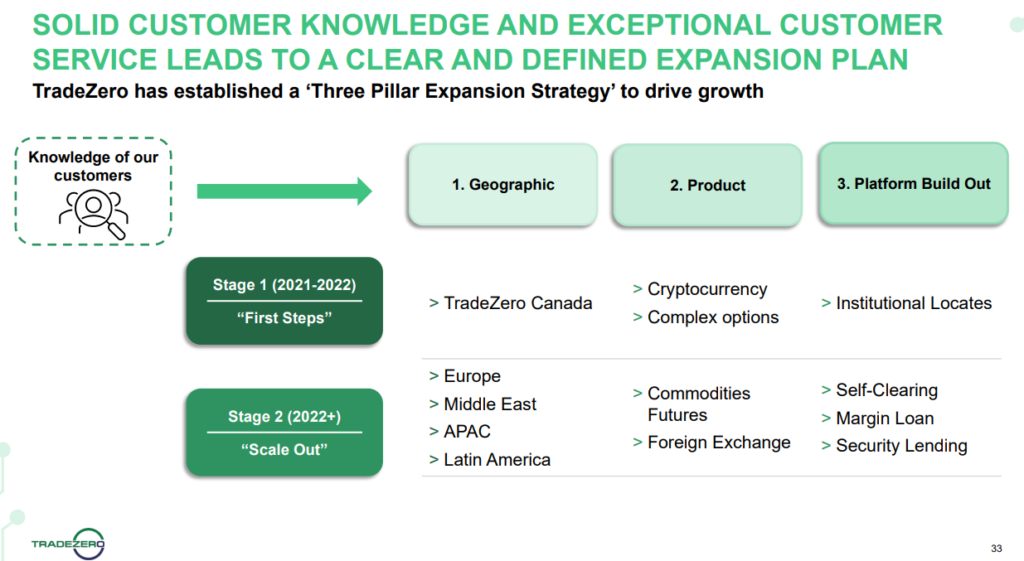

It seemed fitting in a month often known for trick or treating that a huge treat for self-directed investors was the announcement that (yet) another commission-free online brokerage was looking to formally launch in Canada in 2022. TradeZero, a name familiar to very active traders, indicated their plans to expand globally with Canada being an important jumping off point in that roadmap. Excluding the perennial “are we there yet?” questions about tastyworks coming to Canada, the announcement by TradeZero brought the total number of new online brokerages (new commission-free online brokerages) looking to launch in Canada in 2022(ish) to three. In the decade prior to 2021, the number of commission-free online brokerages that were publicly looking to launch in Canada was exactly Wealthsimple Trade long (we announced this back in 2018).

Finally, October was also the month where Virtual Brokers officially rebranded to CI Direct Trading. It had been just over four years since CI Financial acquired Virtual Brokers in 2017; however, the highly recognizable low-cost online brokerage had clearly been paring back on news and announcements post-acquisition. In an interesting (cryptic?) move in September, Virtual Brokers announced its name would be changing; however, it didn’t specify what it would be changing to. Nonetheless, 2021 brought some answers as to what’s going to happen next with Virtual Brokers / CI Direct Trading, and as we saw through the year, rebranding is big project but does set the stage for some transformative moves.

November: Let the Games Begin

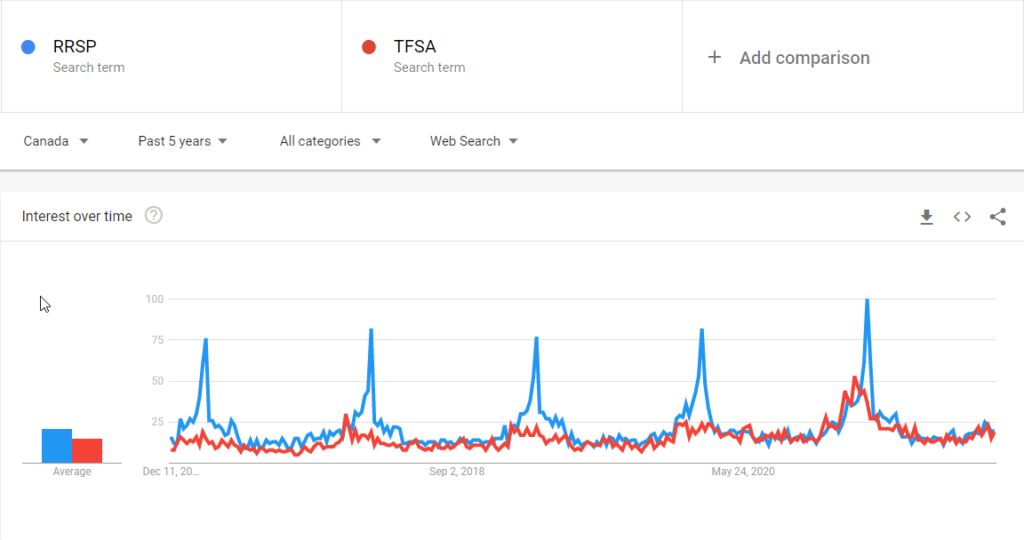

In a month that has now become synonymous with bargain hunting, November didn’t disappoint for DIY investors either. There was a dizzying amount of news to report on but the biggest story for self-directed investors in Canada was the unofficial (but now kinda official) launch of RSP season. While the contribution deadline comes at the beginning of March 2022, the deals and promotions for online trading accounts have now started to appear at the beginning of November, and 2021 was no exception. Some big players in the Canadian online brokerage space came out swinging early, among them, CIBC Investor’s Edge and TD Direct Investing, both of which provided a preview to the highly competitive promotional offers available this season.

Another big theme for this year was in the non-bank-owned online brokerage group launching features to help self-directed investors get started and funded as quickly as possible. Qtrade Direct Investing announced the launch of rapid account opening knocking down the time required to open an online trading account at Qtrade from days to minutes. While getting an account opened quickly is a huge step forward, another big hurdle to clear is account funding. Competitor online brokerages such as Questrade and Wealthsimple Trade worked feverishly in 2021 to address instant account funding (albeit with limited amounts).

On the topic of opening accounts quickly, Robinhood, the poster child for rapid growth in online brokerage accounts, in 2020 and 2021 reported earnings, and for anyone keeping score on their stock price recently, the outlook was not great. Being winter, the phrase “getting ahead of your skis” characterizes the Robinhood story, and the now publicly traded stock has seen a massive sell off in large part because of the stall in momentum from retail investor trading. Specifically, the pull back in options and cryptotrading have clearly hurt the top and bottom lines for this zero-commission brokerage. Beyond the trading in those products, it also appears that after the meme-stock debacle, the “for the people” branding took a significant hit, something that might be keeping newer clients away from considering Robinhood as their online brokerage of choice.

And, speaking of choosing, Interactive Brokers once again reflected that the power of capitalism is ultimately in listening and providing to the market what the market wants. Ironically (or perhaps appropriately), ESG-driven trading is something that Interactive Brokers offers to its clients with the launch of their IMPACT app. Commission-free trading that enables you to make the world better through your investment decisions pretty much nails it for the demographic this app is clearly targeting.

December: Free Fallin’

Even with ice and snow on the ground, it seems like stock markets (and a couple of online brokerages) were doing all the slipping and sliding heading into the end of the year. Yet again, 2021 proved that time distortion and normalcy are not a thing because feature launches and big announcements continued to roll in despite it traditionally being a month when activity among online brokerages gears down for the holiday season.

But the giving season did giveth, or at least asketh to taketh, in the case of Wealthsimple Trade which launched a new subscription-based service. The commission-free brokerage finally addressed (sort of) one of their clients’ biggest pain points, the high cost of trading US-listed stocks by launching access to US currency trading accounts. The devil, however, was in the details, and despite the sizzle on rolling out the feature, there were many important unanswered questions about how converting between currencies would work with the subscription model.

Questrade managed to slide in some interesting new features ahead of the end of the year as well, launching a wonderfully named “RoundUP” service to help make investing digital spare change easier as well as a “cash back” shopping feature in which the worlds of online shopping and online investing collide.

Also, just casually sliding some big news in before the end of the year, Mogo Trade received approval for it to launch its zero-commission online trading platform and opened up the waiting list to be notified of the official go live date.

Finally, we shipped the annual Look Back / Look Ahead series for 2021/2022 in December (see above), and with it we wrapped up what has clearly been an eventful year with insights from Canadian online brokerage leaders. As busy as the year was in 2021, all signs point to even more activity in 2022, with new features continuing to launch, new pricing drops likely to come from existing online brokerages (who haven’t already lowered their prices), some interesting new players on the field, and, naturally, the unknown.

Into the Close

If you’ve made it to this point reading top to bottom, congratulations! Not only are you all caught up on the biggest developments in the online brokerage space for the year, but you’re also well prepared for what’s about to come next in 2022. The start of a new year is often a time for reflection and resolutions, but this new year brings even greater cause for reflection as well as celebration.

After 10 years of publishing the Weekly Roundup from pretty much everywhere life has taken me, there are only a handful of instances where publication has been paused, and they’ve been to tend to the greatest investment anyone can have: family. For that reason, the Weekly Roundup will be going on pause until mid-February.

In the interim, we will continue to be publishing deals and promotions updates, as well as monitoring and sharing interesting content to our Twitter channel and newsletter, so be sure to subscribe to those if you haven’t already done so. Also, we will continue to monitor the online brokerage space for big developments, and like all of life’s great surprises, perhaps don’t be surprised if we drop some interesting posts between now and the return of Roundup.

Until then, Happy New Year, and wishing good health, prosperity, and joy to you and your loved ones for 2022! Here’s hoping we get back to a time where can all fist bump in person again soon.