| Investing Ideas: Research Tips for Dividend Investors |

Dividends |

0:06 |

TD Waterhouse |

Bob Gorman |

video link |

Learn why investors use dividend-paying stock strategies in their portfolios during low interest rate environments. And, see how Do-It-Yourself (DIY) investors use the Screener tool in WebBroker Markets & Research to find the right dividend-paying stocks. |

N |

| Discover Exchange-Traded Funds |

Exchange-Traded Funds |

n/a |

National Bank Direct Brokerage |

Daniel Trempe |

video link |

This webinar will introduce the main fund families, their unique characteristics and advantages |

N |

| Turning Equity Volatility into Yield |

Exchange-Traded Funds |

0:52 |

Scotia iTrade |

Horizons ETFs |

video link |

Discover how to implement alternative strategies to reduce downside risk in a portfolio while generating attractive monthly income with Horizons Actively Managed enhanced income solutions. This innovative approach provides investors with reduced cost and increased tax |

|

| Portfolio Drivers: Investing in Gold, Natural Gas & Other Broad Commodities |

Exchange-Traded Funds |

0:53 |

Scotia iTrade |

iShares |

video link |

We introduce investors to the options, benefits and reasoning behind commodity investing. Discussion topics will include how to access commodities through different vehicles as well as the structural intricacies behind each method. This includes direct investing through the physical commodities, accessing contracts and equities. |

|

| Converting Market Volatility Into Income Using ETFs |

Exchange-Traded Funds |

0:32 |

Scotia iTrade |

Horizons ETFs |

video link |

Currently we see a great deal of volatility in the markets. Join us to learn how to effectively use Exchange Traded Funds to turn market ups and downs into income. |

|

| Income Investing Using ETFs |

Exchange-Traded Funds |

0:34 |

Scotia iTrade |

Horizons ETFs |

video link |

There has been a great deal of growth in the ETF market recently allowing individual investors a great deal of choice when tracking a particular market. Did you know that ETFs can also be used to effectively generate income? Join us to learn about ways to use ETFs to produce an income stream within your portfolio. |

|

| Bonds, The Better Investment |

Fixed Income |

0:57 |

Scotia iTrade |

Scotia iTrade |

video link |

There’s misconceptions around bonds – investors are often unsure of how they work. Joey Mack will provide some surprising facts about bond market returns, and provide guidance over how investors can participate in the top performing asset classes in Canada. |

|

| Educational Summit |

Investing |

1:55 |

Scotia iTrade |

Scotia iTrade |

video link |

Featuring presentations by recognized industry speakers, AJ Monte of The Market Guys who will discuss Managing Risk in today’s markets and Marcus Schlechta of iShares who will discuss how ETFs can help support your investing objectives. |

|

| Take advantage of margin accounts |

Margin |

0:34 |

National Bank Direct Brokerage |

Daniel Bonilla |

video link |

This webinar is an introduction of the characteristics and function, as well as the advantages, of margin accounts. |

N |

| Contract Selection |

Options |

0:58 |

Scotia iTrade |

The Montreal Exchange |

video link |

Find out which option contracts are best suited to meet your specific objectives and how you can apply some simple rules to make contract selection easier. |

|

| The Power of the Put Option |

Options |

1:00 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

AJ Monte of The Market Guys will cover key strategies you can implement when markets take a downturn which will appeal to both traders and investors at all skill levels. |

|

| Investing Ideas: Investing with Covered Calls |

Options |

0:05 |

TD Waterhouse |

Dino Bourdos |

video link |

Learn more about the covered call options strategy as our TD Expert highlights some basic risk and rewards involved in the strategy and why investors may consider using it in a low interest rate environment. Also, see how Do-It-Yourself (DIY) investors use WebBroker to implement a covered call strategy. |

N |

| Five mistakes that options traders make |

Options |

n/a |

Questrade |

InvestView |

video link |

Options can be a good strategy for leveraging your portfolio. However, many new options traders (and, frankly, many seasoned options traders) make the same mistakes over and again. Sign up for this webinar to learn how to avoid the five most common mistakes: |

|

| Advanced Options Strategies: Straddles & Strangles |

Options |

0:57 |

Scotia iTrade |

The Montreal Exchange |

video link |

The purchase of a call and a put simultaneously on the same underlying security allows the investor to take advantage of a volatile move in share price in either direction. Learn which market conditions favour this strategy, what types of stocks to look for and which strike prices and expiration months are |

|

| How to Manage Risk in Volatile Markets |

Risk Management |

0:54 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Join The Market Guys as they describe strategies you can use to limit the downside risk while protecting profits in your stock portfolio. |

|

| The Science of Setting Stops |

Risk Management |

0:59 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Come prepared to join The Market Guys for a REAL-TIME stock charting session where you are invited to provide your own stock symbols for analysis. |

|

| How to Manage Risk Using the 1% Rule |

Risk Management |

0:58 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Join us as Rick and A.J. talk about protecting your downside in these volatile markets |

|

| Profit from Knowing the Best Times to Trade |

Risk Management |

0:46 |

Scotia iTrade |

CyberTradingUniversity.com |

video link |

Many professional traders pick & choose their spots to trade because they know what periods of the day are most likely to lead to profits. Let Fausto teach you the “rhythms” of the market from his decades of experience. |

|

| The 10 Most Frequent Mistakes Traders/Investors Make |

Risk Management |

1:00 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Join AJ Monte of The Market Guy as he covers the major repetitive errors made by traders and investors alike and how to avoid them in your own portfolio. |

|

| The Market Guys Risk Management Strategies for Traders |

Risk Management |

1:00 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

We kick off the first of 3 Risk Management sessions this month with one of the top teachers in the industry. Join us to learn how to protect your stock and ETF positions using various methods. Presented by AJ Monte of The Market Guys. |

|

| Stay Out of Market Maker Traps – and Watch Your Profits Grow |

Risk Management |

0:48 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Learn about common market maker set-ups and how to identify traps from a distance & avoid them to enhance your profits. Presented by: Fausto Pugliese, Founder & President of Cyber Trading University. |

|

| Mechanics of a Short Sale |

Short Selling |

<10 min |

Interactive Brokers |

Interactive Brokers |

video link |

The Mechanics of a Short Sale is a tutorial that is designed to show you the inner workings of how a Short Sale works. |

|

| Short Selling |

Short Selling |

0:33 |

National Bank Direct Brokerage |

Daniel Bonilla |

video link |

This webinar is an introduction of the characteristics and function, as well as the advantages, of short selling accounts |

N |

| Charts & Patterns (a picture is worth 1000 words) |

Strategy |

0:58 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Join The Market Guys as they give you the tools you need to identify patterns and simplify charting. |

|

| Trading Strategies to Consider for 2012 |

Strategy |

1:01 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

It’s a new year with new beginnings and new challenges. What new ideas can you place in your trading and investing toolbox for 2012? Let AJ Monte explore some possibilities with you. |

|

| Combining Technical & Fundamental Analysis |

Strategy |

0:53 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Far too many investors and traders make the mistake of preferring one method of stock analysis over the other. Join The Market Guys as they show you how and why you need to use both. |

|

| Benefit from investing in the U.S. |

Strategy |

0:05 |

BMO Investorline |

|

video link |

|

N |

| Key Strategies for a Bear Market |

Strategy |

1:00 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Have past market downturns made you shy away from investing? Does today’s market volatility have you scratching your head over what to do? Let AJ Monte show you how to position yourself in order to take advantage of a market downturn. This session will be followed by an open Q&A session on Aug. 20th where you can volunteer stocks for analysis. |

|

| Picking Profitable Stocks in Volatile Markets |

Strategy |

1:01 |

Scotia iTrade |

AJ Monte of The Market Guys |

video link |

Does volatility scare you as as investor? Wish you could understand how trends can influence the future possible direction of the markets? Join AJ Monte as he shows you how to make volatility your best friend in the markets by teaching you how to “Follow The Money”. |

|

| Bollinger Bands |

Technical Analysis |

n/a |

Questrade |

InvestView |

video link |

Bollinger bands are a powerful indicator for measuring volatility, which is essentially price movement. Register for InvestView?s Bollinger bands webinar and learn how to effectively use this important tool in your technical analyses. |

|

| Introduction to Technical Analysis |

Technical Analysis |

0:25 |

Interactive Brokers |

Interactive Brokers |

video link |

The Technical Analysis Tour explains the important role of the chart analyst and how technical and fundamental analyses differ. In this introductory tour, you will learn how to identify areas of support and resistance on a chart, the role of different time frames, and how to interpret basic trend formation |

|

| Introduction to Technical Analysis with Recognia |

Technical Analysis |

1:04 |

National Bank Direct Brokerage |

Kathryn Griffiths – Recognia |

video link |

This webinar provides an overview of technical analysis and how it can be used to help make investment and trading decisions. It includes a review of actual patterns and charts as they are identified by the Recognia system and made available to clients on National Bank Direct Brokerage’s transactional website. |

N |

| ETFs best practices |

Exchange-Traded Funds |

0:40 |

Disnat |

John Gabriel – Morningstar |

video link |

John Gabriel from Morningstar discuss ETF best practices, how investors should use ETFs and how to make them part of your portfolio. |

|

| The five pillars of evaluating mutual funds |

Mutual Funds |

0:41 |

Disnat |

Nick Dedes – Morningstar |

video link |

Nick Dedes, Mutual Fund Analyst at Morningstar to discuss the five pillars of evaluating mutual funds. |

|

| Stockscores Canadian Active Trader Expo (SCATE) – 2012 |

Strategy |

0:56 |

Disnat |

Tyler Bolhorn – Stockscores |

video link |

Tyler Bolhorn from Stockscores explains the basics of stock analysis and trading at the 2012 Stockscores Canadian Active Traders Expo (SCATE) |

|

| How to Make a Living Trading the Stock Market |

Strategy |

0:12 |

Disnat |

Tyler Bolhorn – Stockscores |

video link |

Tyler Bolhorn from Stockscores explains how to make trades holding stocks for minutes or days. This is a video to watch if you want to quit your day job to become a full time trader |

|

| Manage Your Retirement Portfolio in Only Minutes a Day |

Strategy |

0:20 |

Disnat |

Tyler Bolhorn – Stockscores |

video link |

Tyler Bolhorn from Stockscores explains how to manage your retirement portfolio in only minutes a day using Stockscores, stops and technical analysis. |

|

| How do you limit your losses? Use options to hedge your portfolio |

Options |

0:51 |

Disnat |

Jason Ayres – Montreal Exchange |

video link |

This recorded webinar explains the safe usage of options as a means to hedge a portfolio against market risk. Learn to use options to help maintain profits and limit losses. |

|

| Emotion Control & Trading – The Mindless Investor |

Strategy |

0:21 |

Disnat |

Tyler Bolhorn – Stockscores |

video link |

Tyler Bolhorn from Stockscores explains to investors how to manage their emotions and risk. Taking emotion out of trading is probably the most important element a trader as to obtain to be successful at stock trading. |

|

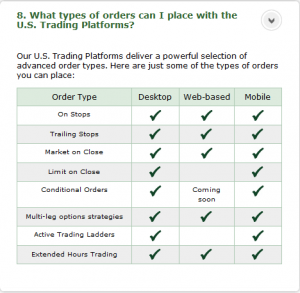

to compete with. Aside from being incredibly well-reviewed and designed, one of the biggest features that Thinkorswim will offer is the robust order type support for both stocks and options. In addition to stop orders, Thinkorswim also supports conditional orders (also known as bracket orders), ladder orders and multi-leg orders. The image (right) was taken from the Thinkorswim Canada section of the TD Waterhouse Discount Brokerage page (click

to compete with. Aside from being incredibly well-reviewed and designed, one of the biggest features that Thinkorswim will offer is the robust order type support for both stocks and options. In addition to stop orders, Thinkorswim also supports conditional orders (also known as bracket orders), ladder orders and multi-leg orders. The image (right) was taken from the Thinkorswim Canada section of the TD Waterhouse Discount Brokerage page (click

Even though discount brokerages haven’t traditionally portrayed the most “fun and friendly” image, more and more of them are starting to become visible on social media sites such as Facebook and Twitter. While you (hopefully) won’t find those embarrassing pictures of a drunken night gone wild or an angry rant about a horrible boss, plugging into the news feeds of a discount brokerage can be an interesting way to get insight into the organization, follow any promotions that may be underway as well as get a glimpse at the conversations they’re having with their customers.

Even though discount brokerages haven’t traditionally portrayed the most “fun and friendly” image, more and more of them are starting to become visible on social media sites such as Facebook and Twitter. While you (hopefully) won’t find those embarrassing pictures of a drunken night gone wild or an angry rant about a horrible boss, plugging into the news feeds of a discount brokerage can be an interesting way to get insight into the organization, follow any promotions that may be underway as well as get a glimpse at the conversations they’re having with their customers.