The arrival of September is generally when markets shake off the quiet days of summer and start to come back to life. Across the landscape of discount brokerages, it looks like the major deal offerings that were around in August are standing firm or are being extended out. For example, Questrade’s 100 free trades offer has been extended until the end of October 30th, 2012.

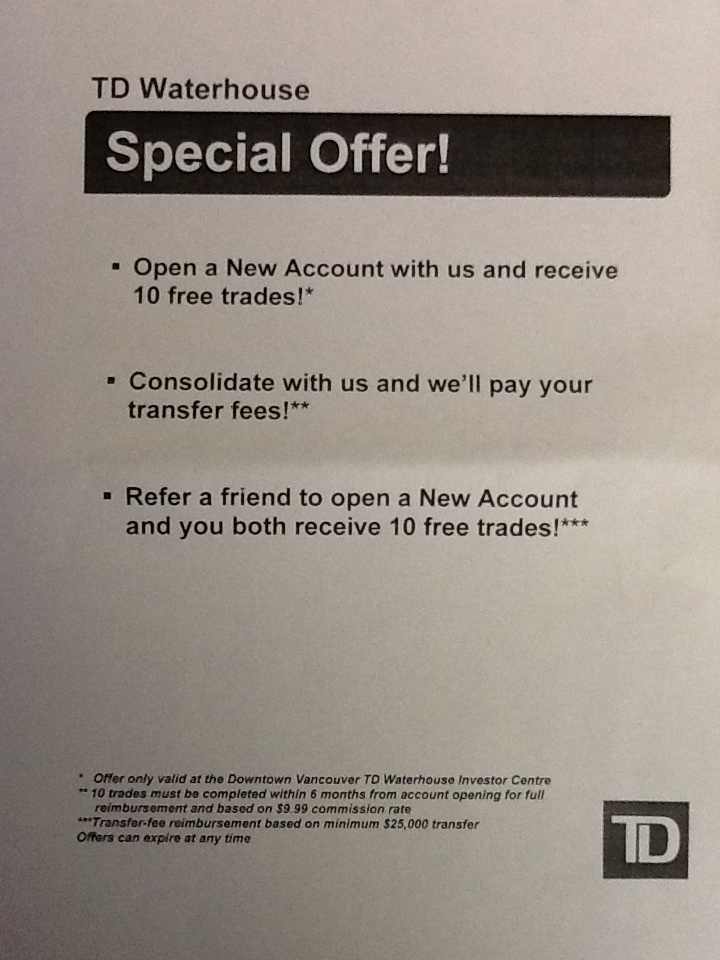

The major offerings of free trades/trade commission rebates continue to be a favourite amongst the discount brokerages with Virtual Brokers, Questrade, Scotia iTrade, National Bank Direct Brokerage all continuing to “give in order to get” investors’ business. An interesting catch is the 10 free trades promotion being offered by TD Waterhouse discount brokerage for downtown Vancouver clients.

Still going strong is the Sparx Trading deal offered by Jitneytrade where you can get exclusive discounts on commission costs and the Realtick trading platform. For more info on the Jitneytrade promotion you can click here. Below you’ll find more online discount brokerage deals and promotions.

| Company | Brief Description | Details Link | Deadline |

|---|---|---|---|

| A Sparx Trading exclusive offer! Use the promo code “Sparx Trading” when signing up for a new account with Jitney and receive access to their preferred pricing package and a massive 45% discount on the Real Tick trading platform. | For more details click here | none | |

|

Open a new account (TFSA, Margin or RRSP) and receive $50 commission credit . Use promo code: kdkfnbbc | none | none |

|

Move your brokerage account to Questrade and they’ll cover the transfer-out fee up to $150. | Transfer Fee Promo | none |

|

Refer a friend to Questrade and when they open an account you receive $100 and they receive $50. To receive this deal you must be an existing client with an equity account and refer a person that does not reside with you and who has not previously opened a Questrade account. | Refer a friend | none |

|

Get up to 100 free trades when you fund an account with a minimum of $10 000. You must open this account by October 30, 2012 and fund it with $10 000 within 30 days of account activation to qualify. You must enter promo code “100FREEQ”. There are quite a few other details, including a minimum balance requirement, so be sure to check the details link. | 100 Free Trades | October 30th, 2012 |

|

Transfer $25,000 or more to a National Bank Direct Brokerage account and they will pay up to $135 plus taxes in transfer fees | Transfer Fee Rebate | none |

|

If you are an existing National Bank Direct Brokerage client and you refer someone to join, you each get $100. To qualify, the referred account must transfer at least $25,000 from another financial institution. If at least $25,000 is transferred, up to $135 of the transfer fee is covered. Use the promo code “FRIEND” when opening the account | Refer a Friend | October 31, 2012 |

|

Holders of National Bank Platinum, Ovation Gold, Allure or Escapade Mastercard or a card identified by a professional association can now redeem À la carte reward points for a contribution to your National Bank Direct Brokerage RRSP or Spousal RRSP account, or the new TFSA (Tax-free savings account). As the principal cardholder you can exchange your points, either partly or entirely, for one or more 100 $ contributions (100 $ = 11,000 points). contact one of National Bank Direct Brokerage’s Investor Services representatives (514-866-6755 or 1-800-363-3511). | Mastercard points transfer | none |

|

Open and fund a new account with National Bank Direct Brokerage with $25 000 or more, and you can receive up to $750 in commission reimbursements. To qualify you must use the promo code “REGISTERED2012” in the general information section of the application form. Reimbursements will be paid in either January or April 2013 depending on date account is opened. See the terms & conditions link for more information. | Commission Holiday Promo | October 31, 2012 |

| Virtual Brokers will cover transfer fees from your transferring institution to a maximum of $150 per account. This offer is only applicable to accounts opened with at least $25,000 in equity before September 30, 2012. | Transfer Fee Promo | September 30th, 2012 | |

| Open a new account with $25,000 before September 30, 2012 and receive 150 trades free. (Applies to the first 150 trades placed within 60 days of account opening at a maximum of $6.49 per trade with a total maximum value of $973) | New Account Promo | September 30th, 2012 | |

| Open and fund a new Scotia iTRADE account with at least $25,000 before September 30, 2012 and the commissions associated with your first 100 trades placed within 60 days of the date the account is activated and funded. Also, the new FlightDesk platform is being offered for free for 60 days. See details link for further terms and conditions. | Scotia iTrade 100 free trades + FlightDesk | September 30th, 2012 | |

| Existing BMO Investorline clients who refer a ‘friend’ who then opens an account, (and the “friend” too) can qualify for a cash bonus, depending on the deposit amount. For deposits of between $50,000 and $249,999, the referral bonus is $200 and the “friend” receives $50; for deposits of over $250,000 the referral bonus is $300 the “friend” receives $100. To qualify for the deal, the referral reference code needs to be included in the application – see the details link for terms and conditions. | Refer a Friend Promo | December 31, 2012 | |

| Open a new account with $150,000 or more (or for existing clients make a deposit of $150,000 or more) and get $150 cash back and 150 free trades. Use the promo code BONUS when opening a new account (or when making a new deposit of $150,000 or more). See the details link for qualifying account types and conditions. | 150/150 Promotion | October 31, 2012 | |

| Open an account with $25,000 or more and receive 10 free trades. This offer is only valid at the downtown Vancouver TD Waterhouse Investor Centre. 10 trades must be completed within 6 months of account opening; reimbursement based on $9.99 commission rate. | scanned photo of flyer | none | |

|

Qtrade Investor will reimburse your transfer fee up to $125 when transferring a balance of $25,000 or more. For reimbursement, please mail or fax a copy of your statement from the transferring institution that shows the transfer charge to Qtrade Investor at 604.484.2627 and indicate your Qtrade Investor account number. | Transfer Fee Promo | none |

| Switch over your brokerage account to Credential Direct and they will cover the transfer fees up to $125 of the charge from another brokerage. If you are not satisfied within 90 days, you can also switch out of Credential Direct for free. To qualify you need to transfer at least $5000 and use the code “Switch Me”. | Switch Me Promo | September 30, 2012 |