Even though it’s still technically winter, it feels like a ‘white dress vs blue dress’ moment. Sure the calendar says it’s the end of February but there’s a major difference between what winter looks like in Vancouver vs Toronto. Regardless of which version of winter DIY investors are riding out, there’s something that everyone can agree on: the competition between Canadian discount brokerages has been undeniably fierce.

Even though it’s still technically winter, it feels like a ‘white dress vs blue dress’ moment. Sure the calendar says it’s the end of February but there’s a major difference between what winter looks like in Vancouver vs Toronto. Regardless of which version of winter DIY investors are riding out, there’s something that everyone can agree on: the competition between Canadian discount brokerages has been undeniably fierce.

In this edition of the roundup, we take a look at deals and promotions poised to expire in and around the RSP contribution deadline; news about one online brokerage getting approval for clearing activities; an assortment of news that DIY investors are going to want to put on their radars and we’ll cap off the roundup with a look across the investor forums.

Sprint to the Finish

If the expiry dates on deals are any indicator of important times in the calendar year, then the run up to the RSP contribution deadline (March 2nd) is by far the most important time for Canadian discount brokerages.

As February closes out, there are at least nine deals/promotions set to expire between February 26th and March 2nd. Here’s the list of offers heading out (or already out):

- HSBC InvestDirect – Winter Offer

- RBC Direct Investing – Trade Free for 1 Year Offer

- BMO InvestorLine – Tablet Promo

- Questrade – MultiLeg Offer

- Questrade – Unlimited Trading Offer

- Questrade – RSP Promotion

- Questrade – Prepaid Visa Offer

- Virtual Brokers – RRSP Free Trade Promotion

- CIBC Investor’s Edge – Free Trade + Cash Back Promotion

There are also a couple of contests linked to the RSP season (e.g. from Qtrade Investor) that are set to expire March 2nd.

Clearly Questrade has been the most active of any discount brokerage in terms of offering up deals and promotions. As a result, it seems that others have largely followed suit. The timing of these offers is definitely meant to take advantage of the fact that so many individuals will be thinking about and contributing to RRSPs just ahead of the deadline.

For Canada’s discount brokerages, February 2015 saw the record for highest number of advertised promotions since we’ve been measuring these. We observed at least 24 listed offers (26 if offers not listed on SparxTrading.com are counted). Unadvertised offers as well as ‘negotiated’ deals have been reported by individuals on investor forums too, signaling that even more bonuses and incentives are out there.

There has been a fierce battle between providers in the lead up to the RSP deadline however the deals/promotions are likely to pull back once the dust settles. Click here to view all the deals/promos.

Getting Clearance

Earlier this week, Virtual Brokers announced that their parent company, BBS Securities Inc, was approved for membership with the Canadian Derivatives Clearing Corporation (CDCC). And, while this doesn’t necessarily impact the experience of most of the DIY clients, this does enable Virtual Brokers to better monetize the process of clearing options transactions.

According to their corporate brochure, the “CDCC, a wholly-owned subsidiary of the Montréal Exchange (MX), acts as the central clearing counterparty for exchange-traded derivative products in Canada.”

As a clearinghouse they coordinate the transaction process and associated settlement tasks. In addition, the CDCC acts as a central counterparty for trades on the Canadian derivatives (e.g. options, futures) markets. A clear explanation of the CDCC can be found on their FAQ page here.

Other Canadian discount brokerages that are members of the CDCC include Interactive Brokers Canada, Questrade, Credential Securities as well as many of the parent brands of the bank-owned brokerages. The full clearing members list is available here.

Given the risks associated with trading derivatives, there is the need for strong controls to be in place. For most DIY investors that decide to trade in options, in particular Canadian options, many of these risks are controlled at various point through the trading process to the point where they go largely unnoticed. An interesting overview on the CDCC prepared by Standard & Poors (although it’s a bit dated) can be found here.

Interesting Developments

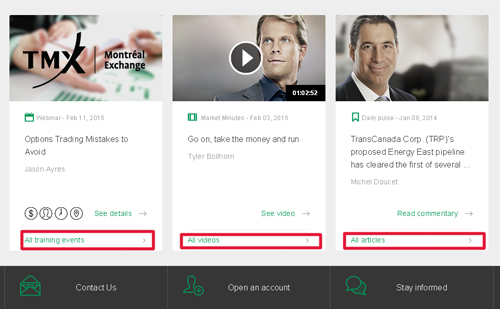

For those who follow the Canadian markets closely, newer entrants (such as Aequitas) and smaller players (such as the Canadian Securities Exchange) are definitely making headlines. In terms of the CSE, their recent successes at growing the number of companies listed on their exchange reflects their desire to become a serious contender to a much bigger incumbent. In another bold move, the CSE has announced the launch of an index, the CSE Composite Index, that now tracks securities listed on that exchange.

There are many interesting features to this index, which is being managed by a German firm Solactive AG, the primary one being the composition of the index. The CSE Composite Index, which is made up of 64 listings, has the following sector weightings as of January 30, 2015:

- Technology: 47.27%

- Diversified Industries: 25.66%

- Mining: 16.17%

- Life Sciences: 7.28%

- Cleantech: 1.85%

- Oil & Gas: 1.77%

Like most other indices, the criteria for inclusion can determine what kinds of companies end up comprising the index. For more detailed information on the new CSE Composite Index, check the information page here.

Changing the Channel

In another big announcement for the financial information landscape in Canada, financial news giant Bloomberg announced that they, in partnership with specialty channel operator Channel Zero, will be launching a Canadian financial news television channel. Currently BNN (owned by Bell Globe Media) holds an exclusive position in the business television space.

The move by Bloomberg will likely force BNN, which already produces a relatively high quality product, to step up their game. The Bloomberg brand is very well known and carries not only the weight of its reputation for business news journalism but also the sheer scale of resources to get information on markets locally and internationally.

For DIY investors it will be interesting to see how well the Canadian edition of Bloomberg fairs. There will still be significant business content from the parent Bloomberg channel simulcast so a large amount of US-based news will be streamed through. After all, not every import from the US is guaranteed to succeed (Target anyone?) in Canada – it will take a solid understanding of the viewership in Canada and something genuinely enticing to win the loyalty of BNN viewers. Either way, it should be an exciting launch.

From the Forums

#OnlineInvestingProblems

In this post from Canadian Money Forum, one user has a particular gripe with the onboarding process with Scotia iTrade. In today’s world of online applications, it seems that doing things the ‘old fashioned’ route of paper forms was the source of grief. The responses from other members, however, provided some sober insight on how other brokers fare.

Just TFSA No

With registered accounts on everyone’s mind, TFSAs are a natural talking point. One forum user, however, was curious to know which brokerage would be able to help out with an OTC (Over the Counter) stock for a TFSA. The responses, however, cleared the air on an important point that only approved exchanges (which does not include the OTC/pink sheets) are eligible for TFSAs. Click here to read more.

Nimoy Tribute

A wagon train to the stars was how Gene Roddenberry promoted and ultimately sold his vision for Star Trek, as a television series, to a group of NBC network executives in the early 1960s.

As readers may know, Leonard Nimoy, who portrayed the iconic character Spock, has passed away. He was 83. The staff at SparxTrading.com is passionate about Star Trek and its vision of a better tomorrow. The roundup wishes to celebrate a life well lived and pay tribute to Mr. Nimoy.

For a nice retrospective, you may be interested in visiting the Star Trek website; NASA also paid tribute to Mr. Nimoy and thanked him for inspiring generations of engineers, scientists and explorers. Finally, here is a simple, yet eloquent video with a wonderful message and we hope the words resonate with you, as they have with us. Live long and prosper.

If Friday the 13th was supposed to be an unlucky day, somebody forgot to tell stock markets. Heading into Valentine’s Day weekend bullish investors saw fifty shades of green as they pushed markets to a record high close, yet again. Fittingly, Canadian discount brokerages were also out looking for love from DIY investors offering up just about everything but flowers and chocolate.

If Friday the 13th was supposed to be an unlucky day, somebody forgot to tell stock markets. Heading into Valentine’s Day weekend bullish investors saw fifty shades of green as they pushed markets to a record high close, yet again. Fittingly, Canadian discount brokerages were also out looking for love from DIY investors offering up just about everything but flowers and chocolate.

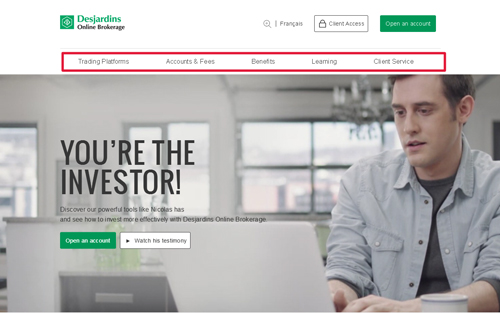

Canadian discount brokerages are hitting February at full speed. With a slew of deals, events and the roll out of new features it doesn’t appear like very much will be slowing down the activity at Canada’s brokerages.

Canadian discount brokerages are hitting February at full speed. With a slew of deals, events and the roll out of new features it doesn’t appear like very much will be slowing down the activity at Canada’s brokerages.