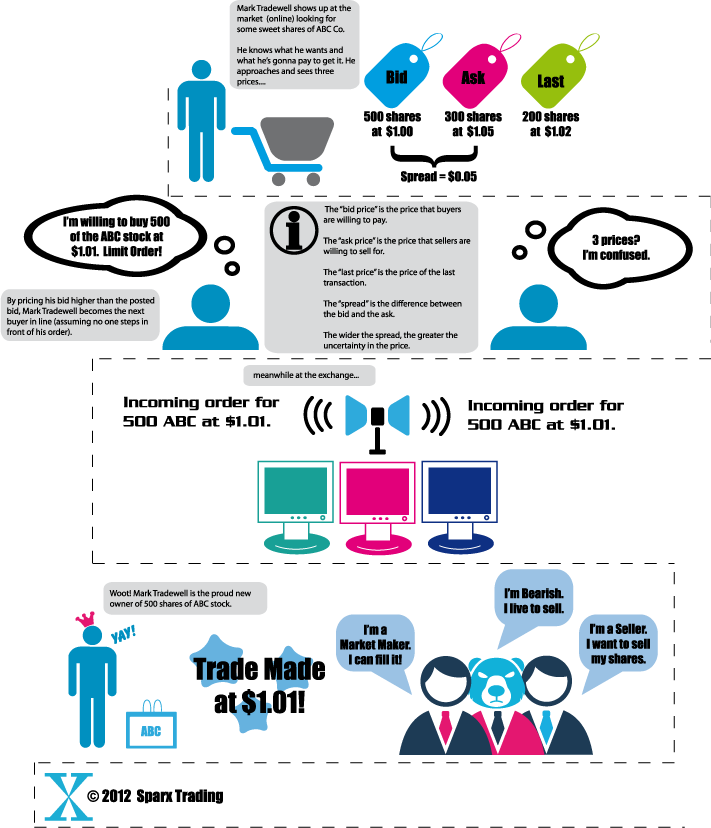

In this episode of Mark to Market, Mark Tradewell learns about the limit buy.

In this episode of Mark to Market, Mark Tradewell learns about the limit buy.

One of the great ‘disadvantages’ to beginner investors is how to put what they hear and see in the news or what they are told by financial sales staff into context. One solution to get that context is through education. While most people would probably agree that taking the time to learn about investing is important they simply don’t have the time to do so or know where to start or who to trust.

It is through that lens that Danielle Park’s book, “Juggling Dynamite: An insider’s wisdom about money management, markets and wealth that lasts” is probably one of the most valuable starting points for Canadian retail investors.

Unlike some books about investing that focus solely on money, Juggling Dynamite takes a thoughtful and uncomplicated look at building wealth and understanding that getting money is important but keeping money is even more important in the long run. According to Danielle Park, there are no shortcuts or “extreme makeovers”, but rather a daily commitment to learning and sound decision-making. Specifically, the keys to successful investing and wealth management rely on having the patience and discipline to both identify and wait for the right opportunities to present themselves.

The well-written and matter-of-fact style of this book is a breath of fresh air in a landscape stuffed with sugar-coated sales pitches and fantastical claims about the benefits of investing in stocks, mutual funds and many other investment vehicles. Because of her experiences within the financial industry, Danielle Park is uniquely able to provide an “insider’s view” of how the investment industry is designed to work to separate investors from their capital. For example, Danielle Park writes

Waiting for the right investment at the right price is not a strategy well received by an investment industry paid to promote transactions. Most investment professionals are paid to come up with buy ideas. Fund managers are paid to buy things, not to sit in cash. This is the bias inherent in the system. (p56)

While providing a fascinating and much needed look into how investments are presented to the public, this book also provides a great overview of how market and business cycles influence when being in certain investments such as stocks, ETFs or mutual funds makes more sense and when it does not. This is a powerful piece of insight that runs contrary to much of the financial advertising and “conventional” buy-and-hold wisdom, however as Danielle Park concisely points out “To regular folks, 5-, 10-, and 20-year cycles matter most in their lives. Few people invest all their money with plans to look at it fifty or more years down the road” (p32)

Even though the financial industry is quick to point out that “past performance doesn’t necessarily guarantee future results” stepping into a market without having first taken a look at market cycles and historical behavior means that a different phrase will probably apply, namely “those that fail to learn from history are doomed to repeat it”. As a great irony and first lesson of the value of history, Juggling Dynamite was published in 2007 just ahead of the greatest financial disaster of this generation. Too bad more people didn’t read it then.

For more information about Danielle Park, you can visit her website at www.jugglingdynamite.com

Check out our interview with Danielle Park here

You can also purchase this book online via the link below:

To read five other reviews of this book you can click here.

One of the largest publicly traded discount brokers, Interactive Brokers Group Inc. (better known as Interactive Brokers or ‘IB’) published their monthly trading data for March 2012. Many industry commentators and trader’s alike have observed a decrease in the trading volumes over the past several months. An interesting data point that confirms that observation comes from the March 2012 report which shows a decrease of 7% in Daily Average Revenue Trades (DARTs) from the past month. Options contracts also decreased about 19% relative to last year, however it actually increased 6% over the previous month.

Both volume and volatility are attractive to traders, and the recent decline of both trading volumes and share price volatility mean more than a few traders are growing impatient with the current market environment. Odd as it may sound, markets have to make participants money in order for them to survive. Active traders are key to efficiently functioning markets however low price volatility or fewer numbers of participants mean less than ideal trading conditions and therefore less profitability.

Eventually as people exit the trading game or stop trading stocks, there are fewer participants and prices are likely to get volatile. That volatility will signal profitability for traders and traders may want to step back in at that point.

The lesson – supply and demand also applies to volatility in stock prices and right now equity markets appear to be quietly frustrating volatility seekers. Using discount brokerage data is a great proxy on the retail investor’s trading behaviour in the marketplace and also a helpful way to figure out trends in the market.

To read more about their results you can find a great article here: http://yhoo.it/HFGoHq or if you want to read the report directly you can find it on Interactive Brokers’ website here: http://bit.ly/IFDYvH

This stop on the World Money Show circuit brought with it quite a few interesting speakers and exhibitors. The list of speakers included such notable Canadian personalities as Larry Berman and Danielle Park, both of whom had very good turnouts (Danielle’s was standing room only!). Some international guests included Marc Faber, aka “Dr. Doom” who managed to keep audience members nervously amused at his analysis of current financial markets and the potential pitfalls to come.

In addition to some great and opinionated speakers, there were several interesting exhibitors including several discount brokerages, some very well-known American large cap companies, such as GE and Proctor & Gamble, as well as one of the newer Canadian stock exchanges, Alpha Exchange.

These events present great opportunities to learn more about investing and trading and even pick up some very cool promotional items (my personal favourite was the slick Alpha Exchange water bottle). While having to be on your guard about giving your information away, some incentives like shares in GE or Proctor & Gamble are pretty tempting conference promotional items.

Like many conferences, being prepared makes for a much less overwhelming experience. Even though it’s important to know who you are most interested in listening to, sometimes it is also important to get different perspectives on investing ideas you’re considering.

To find out more about the MoneyShow series of events, you can visit their website at: www.moneyshow.com.

If you’d like to find out about other investment conferences and events, including investment education webinars going on in Canada, you can check out our events page.

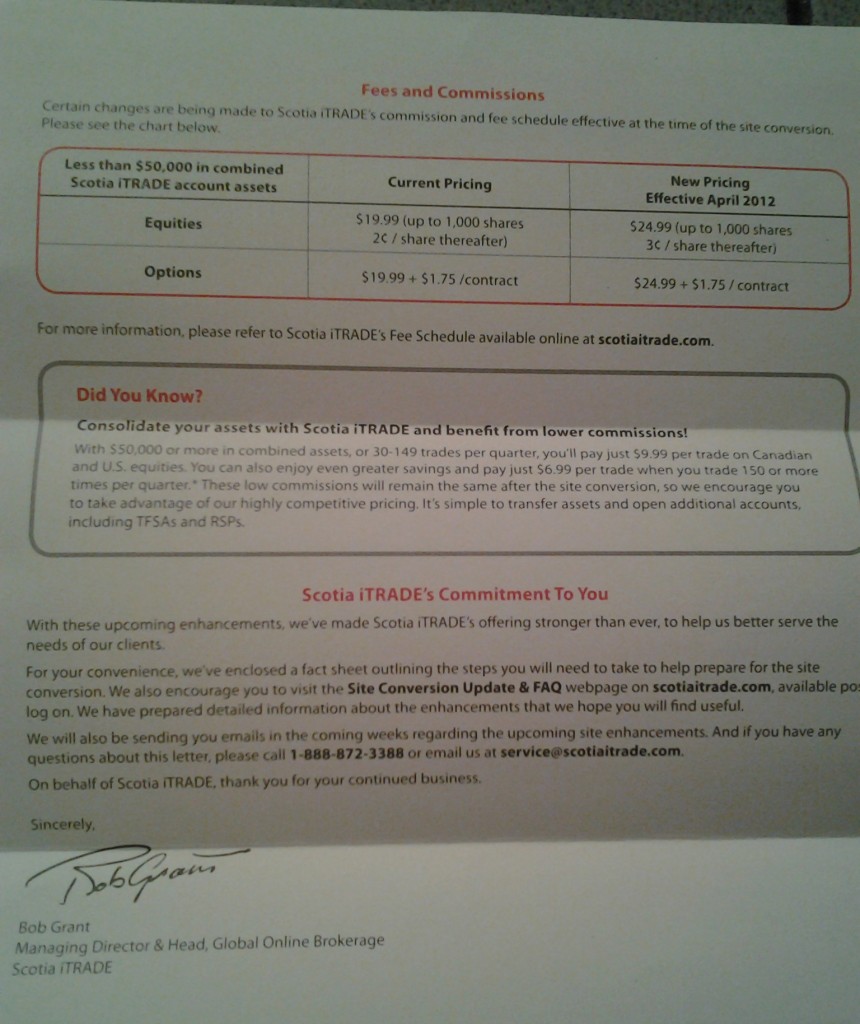

Scotia iTrade is raising how much they charge for their ‘standard’ commission per trade rate from $19.99 to $24.99 for equity trades effective April 2012. Specifically, it’s $24.99 per trade (up to 1000 shares) and $0.03/share for orders greater than 1000 shares. Option commissions are also going up from $19.99 +$1.75 per contract to $24.99 + $1.75 per contract.

Standard rates apply if you have less than $50 000 in combined Scotia iTrade assets or trade less than 30x per quarter.

Tough break for the buy & holders just getting started. As an alternative to trading individual company stocks though, there is the choice to trade commission free with certain ETFs.

As of the time of writing this post(April 6th 2012), Scotia iTrade has not updated their website, however this notice (see picture) was sent to clients in March 2012.

Here are the latest discount broker deals and promotions offered by Canada’s online discount brokerages. This month there is a monster deal being launched by Disnat Direct called the “Active 5” deal. Look out for other deals being announced from National Bank Direct Brokerage early this month. If there’s a deal or promotion that we’ve not included, drop us a note here and we’ll look into adding it to the list.

While we strive for accuracy in our reporting we cannot guarantee that the information presented below will not have changed or be altered without notice. Please ensure to check the brokerage’s website directly for full details.

| Company | Brief Description | Details Link | Deadline |

|---|---|---|---|

|

Open a new account (TFSA, Margin or RRSP) and receive $50 commission credit . Use promo code: kdkfnbbc | none | none |

|

Move your brokerage account to Questrade and they’ll cover the transfer-out fee. | Transfer Fee Promo | none |

|

Maximize your returns. Get up to 1% (or more) of your mutual fund value rebated back to you. | Mutual Fund Rebate Promo | none |

|

Open a new account with Questrade and you could qualify for a new iPad. To enter in a draw for 1 of 10 iPads, you can open a new account and deposit $1000. If you deposit $250,000 or more, you will get a free iPad (applies to both new and existing clients) | iPad Promo | May 31, 2012 |

| Transfer a value of $50,000 or more in assets to Disnat Direct (from a non Desjardins account) and receive a $500 credit (valid for 3 months) which can be applied to regular commissions or account transfer fees | $500 Credit | May 1, 2012 | |

| Transfer a value of $50,000 or more to your Disnat account (from a non Desjardins account) and receive $300 and free access to their GPS portfolio management tool for a year. Money will be deposited to your account within 30 days of your completed transfer. They will reimburse any transfer fees charged by the transferring firm (up to $150 per account). | GPS Promo | Limited Time Offer | |

| A monster deal called the “Active 5 Deal” being launched by Disnat: 5 Months of no platform fees on DD Xtra & DD Web (includes no fee for TSX venture quotes) 5 Months trading on the best commission rate of $5 50 free trades ($250 commission credit) 5 Months access to Tyler Bollhorn’s daily newsletter $500 off Tyler Bollhorn’s live trading course | Check back soon for details! | TBD | |

|

For new clients: Transfer a value of $100 000 to National Bank Direct Brokerage and reference code: NBDB25 on signup form (section 13). For existing clients: call customer service to let them know you want the deal. The Deal: Get 250 trades for $0.25 each Lots of fine print to read for this deal – click on the link to find out details | 25 years. 25 cents deal | April 30, 2012 |

|

Transfer $25,000 or more to a National Bank Direct Brokerage account and they will pay up to $135 plus taxes in transfer fees | Transfer Fee Rebate | none |

| Open a new account with BMO Investorline and you could receive cash back. For a $50,000 deposit/transfer – you get $100; for a $100,000 transfer, you get $250 cash back; for a $250,000 transfer/deposit you get $600 cash back. Enter the code BONUS when you open your account. | BMO transfer offer | June 1, 2012 | |

| Switch your account to Credential Direct and they’ll pay up to $125 of the transfer fees your online broker charges. If after 90 days you’re not completely satisfied, Credential Direct will waive the $125 transfer out fee. To qualify, you must deposit at least $5000 within 30 days of opening a Credential Direct account. Promo code “SWITCH ME” | Switch Me Offer | June 30, 2012 | |

|

Become a new National Bank Direct Brokerage Client before June 30, 2012 and receive a fixed rate commission of $6.95 for 6 months. Minimum deposit not specified. Promo code “TRADE2012”. Note: National Bank is releasing a similar promo early April where you have to open a margin account to receive 6 months at $6.95 – according to customer service details to be released soon. | Call customer service: 1-800-363-3511 | June 30, 2012 |