Tax Free Savings Accounts (TFSA)

Many of you are probably familiar with the saying: “the only sure things in life are death and taxes.” Well, as of January 2009 there’s been a little ray of hope as far as those taxes are concerned. In February of 2008 the Canadian Minister of Finance (Jim Flaherty) announced a new program would start in 2009 that would forever change how Canadians can choose to save their hard-earned money.

Before the TFSA was introduced, if you saved or invested your money(the money you would have already been taxed on) you would then go on to be charged more taxes if those savings or investments made money. Many Canadians felt that they were being punished despite trying to do the right thing by saving or investing. While many of those same rules are still in place, the reason a TFSA is so innovative is because it gives Canadians an option to save and grow their money without having to pay any taxes on it. Sounds like a great option to us.

What is a TFSA exactly?

A TFSA is a special type of account that enables Canadians to grow the money in the account tax-free. Whether the money is in cash or is invested in allowable products (such as stocks or GIC’s) any money made within a TFSA account will not be taxed. For example, when most people saved money in a bank they generally put the money is a savings account. Aside from keeping the money safe, there was the added bonus of gaining some interest for parking your money there. The consequence of earning some interest is that it can be taxed as income by the government. In a TFSA, however, any money earned in the TFSA is not taxable by the Canadian government – ever.

How it works?

Most large Canadian banks as well discount brokerage firms offer a TFSA. Opening a TFSA is generally as simple as opening any other account at these institutions. In order to qualify for getting a TFSA however you have to meet the following criteria:

- You have to be a Canadian resident

- You have to have a Social Insurance Number

- You have to be 18 years of age or older

The government has set a limit on the amount of money you are able to contribute into your TFSA in any one year. In the first year of the program (2009) the amount was set at $5000 and every subsequent year this amount increases according to the inflation rate. As of 2013, the limit will now be $5500.

The good news is that you are able to carry forward any unused contribution room to future years so even though you might not have opened a TFSA in 2009, you have accrued the contribution room since that time. The CRA will provide the contribution room figure on your income tax statement (called the Notice of Assessment).

To help understand better how a TFSA works, let’s walk through an example. Suppose you had $1000 to save in the first year (2009) and you decided to put that $1000 into a TFSA. Your contribution limit for the year was $5000 but since you only used up $1000, you’re left with $4000 of extra room for that year. As of January 1st the following year your contribution room would increase by $5000 plus any unused contribution room from the prior years ($4000) bringing your grand total of contribution room to $9000. The exact amount of contribution actually is slightly more than $5000 each year because of inflation. Your personal amount can be found on your tax return or via Canada Revenue Agency’s “my Account” website [http://www.cra-arc.gc.ca/myaccount/] .

Some Limitations…

There are, however, some important limitations to how you can access the account that you should be aware of. Probably the one that causes the most trouble for people is in understanding how money can be put back into a TFSA after it has been withdrawn. Even though you can withdraw money from a TFSA without any tax penalties, you have to keep track of how much you removed and how much contribution room you have left for the year because the CRA will penalize you if you over-contribute (i.e. put more money in your TFSA than you are allowed to).

Let’s use an example to clarify. Suppose you have $5000 of contribution room in 2010 and you decide that in January you want to put $4000 into your TFSA. Since you have $5000 of contribution room then depositing $4000 will not exceed your contribution limit and therefore not result in any penalty and it leaves you with $1000 of contribution room for the rest of the year. Now let’s suppose that in June you need to make some repairs to your home so you remove the $4000 from your TFSA.

Here’s where it gets a bit tricky – because you have already made a “contribution” of $4000 you only have $1000 of “contribution” room left for the calendar year of 2011. If you decide to put money back into the TFSA, that would count as a “contribution” and so you would only be allowed to “contribute” $1000 more for that year. If you tried to deposit $4000 you would actually go over your contribution limit by $3000 ($1000 remaining contribution room – $4000 deposit) at which point CRA would penalize you for every month you have that excessive amount ($3000). To quote the CRA website:

You cannot contribute more than your TFSA contribution room in a given year, even if you make withdrawals from the account during the year. Withdrawals from the account in the year will be added to your contribution room in the following year. If you over-contribute in the year, you will be subject to a tax equal to 1% of the highest excess TFSA amount in the month, for each month you are in an excess contribution position (http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/tfsa-celi/wthdrwls-eng.html )

Although it sounds a bit complicated, just remember that your total deposits for the year cannot be more than your contribution limit each year, regardless of how much you remove. The good news is that you “get back” the contribution room at the start of the following year. So in our example above if the contribution room as of January 1st 2011 is set to $5000, that would mean that you could deposit up to $5000 + $4000(the amount you removed from the past year) = $9000.

Why get one?

Earning money is hard enough for most people, so when we see those deductions from our paycheques we know that what we earn isn’t necessarily all we take home. While it’s not a knock against taxes, from the point of view of the individual, to get ahead you and your money have to factor in taxes. Having the opportunity to put your money to work and then be able to have it grow means that it is working more efficiently. Remember that the harder your money works, the harder you don’t have to.

While traditional savings strategies are safe, they typically do not earn much of a return. On the other hand, because you are able to buy other investment products through your TFSA (such as stocks) you are able to take advantage of more strategies (such as dividend paying strategies or capital gains strategies) without incurring extra tax consequences. Another important catch however is if you decide to invest the money in your TFSA in a stock and you suffer a loss on the stock, you can’t claim the capital loss against any capital gains.

There are many reasons people open up and keep a TFSA – they may be saving for a rainy day or just saving for a special vacation or specific purchase. Others use their TFSA to get the most out of their investments. For those who like to trade stocks and are good at it (big catch there!) a TFSA is an amazing opportunity to lock in tax free gains. While TFSAs are a lot like other normal bank accounts, there are some things you’ll want to be aware of if you have one or are looking around for one.

What you need to ask when shopping around

One of the first things you’ll want to know about is if there are any fees associated with opening or holding a TFSA with a financial institution. Not many institutions charge them, but a few do have an annual charge so be sure to ask if there are any annual fees for holding a TFSA. Also ask if there are any minimum balance requirements (i.e. do you have to keep a certain balance so that you don’t get charged fees)

The next thing you’ll want to know is what kind of transfer out fee they charge. For example if you are unhappy with either the service or you just want to change financial institutions, how much will you be charged if you want to switch. All of the brokerage firms we reviewed charged anywhere from $60 to $150 to transfer out of a TFSA. Be sure to also ask if they distinguish between partial transfer out and full transfer out.

One of the worst kinds of fees are those that are charged for accessing your money. Only two brokerages we reviewed actually charged a withdrawal fee ($25), so be sure to inquire whether or not you get charged if/when you want to withdraw your money.

Lastly, for those individuals who would like to use their TFSA to trade currency or stocks or simply to hold US Dollars, make sure to enquire about whether they a) have a US dollar account for TFSAs and b) if there is any annual charge.

We’ve actually reviewed many of the brokerages’ TFSA offerings/costs and you can access that review by clicking here.

To find out more information:

Of course we wanted to provide you, the reader, with a great overview of TFSA’s. There are some sites that we highly recommend you check to get the latest and most official information on TFSA’s.

The first is the CRA TFSA guide for individuals located here: http://www.cra-arc.gc.ca/E/pub/tg/rc4466/rc4466-e.html

This is the official guide – so chances are if you have a question about TFSAs you can find it answered here although don’t expect too many great tips/strategies from it, it’s basically the rule book.

If you’re looking for great tips or strategies on how to use your TFSA, there are many great blogs/sites out there that can help. A great book that will give you a comprehensive but very readable look at TFSAs and when they work best for you is by Gordon Pape.

Lastly, even though there may be some sales pitches that come with it, talking to your financial planner or your bank’s financial planner is very worthwhile. There are usually free seminars at some point that banks provide but if not, booking an appointment can be a great way to get your questions answered.

The bottom line…

Regardless of what you’re saving for, whether it is that new roof, minivan or Bengal Tiger for the backyard, the “Mighty” TFSA is a way to keep your money working harder and smarter for you.

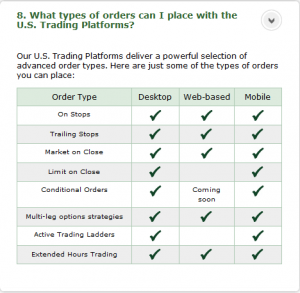

to compete with. Aside from being incredibly well-reviewed and designed, one of the biggest features that Thinkorswim will offer is the robust order type support for both stocks and options. In addition to stop orders, Thinkorswim also supports conditional orders (also known as bracket orders), ladder orders and multi-leg orders. The image (right) was taken from the Thinkorswim Canada section of the TD Waterhouse Discount Brokerage page (click here to see the full page) in reference to the order types available on the platform.

to compete with. Aside from being incredibly well-reviewed and designed, one of the biggest features that Thinkorswim will offer is the robust order type support for both stocks and options. In addition to stop orders, Thinkorswim also supports conditional orders (also known as bracket orders), ladder orders and multi-leg orders. The image (right) was taken from the Thinkorswim Canada section of the TD Waterhouse Discount Brokerage page (click here to see the full page) in reference to the order types available on the platform.