Who is the Penny Plan for?

Realistically, not too many investors are going to be buying 1 share at a time (and hence only pay $0.01 per trade). Investors who occasionally rebalance their portfolio holdings (e.g. a couch potato strategy), investors with modest portfolio sizes and investors who trade small share lots (<495 shares) are the ones who stand to benefit the most from the pricing change.

Very active traders (for whom cost per trade is always a major concern) will almost certainly kick the tires on this offer as well. At $0.01/share certain scalp trading strategies could become more appealing (e.g. trading the TSLA’s and AAPL’s) and day/swing traders might also take advantage of the fact that costs for commissions on the Penny Plan (like the 99 plan) are capped at $9.99 with no ECN fees. So why aren’t traders beating down the doors to Virtual Brokers like a mad mob on a Black Friday sale? Well, with any good deal there are certain strings that make the offer somewhat less appealing for very active (scalping) intraday traders.

What’s the catch?

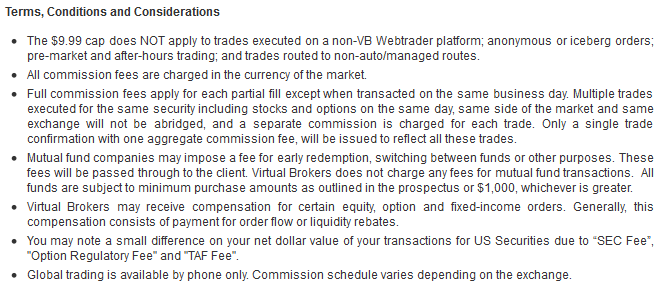

The biggest catch to this offer is that only trades placed using the VB webtrader platform qualify for the 9.99 (and no ECN fee) cap. For many active traders, the standard offering of this particular platform may not be ideal for making quick order entries and watching bid/ask levels. In addition, while snap quotes are free on the VB webtrader platform, data fee packages for real time streaming quotes are not. Packages starting at $18.25 per month and going up to $104.50 per month are available for those seeking real time quotes however it is the added cost of data that can dramatically increase the total cost of trading. In addition, the $9.99 cap also doesn’t apply to trades placed outside of normal market hours, anonymous/iceberg orders and trades routed to non-auto/managed routes. For traders who like controlling when and where their trades go, unfortunately this plan could get pricey with large trading volumes. For most investors, however, only the monthly data cost could be a materially significant issue should they choose to enable this feature. Here is a screenshot of the terms and conditions of the Penny Plan from Virtual Brokers’ site.

The Bottom Line

The Penny Plan for Virtual Brokers is great news for do-it-yourself investors and a huge disruption for other Canadian discount brokerages competing on price. In addition to the pricing of this new offer, Virtual Brokers also allows clients to switch between the plans they offer. In other words, clients can switch between the Penny Plan, the Per Trade Plan or the Per Share Plan from one day to the next at no cost so that the client can match pricing plans according to their trading needs for the day.

In terms of price and flexibility, Virtual Brokers has certainly thrown down a challenge to the rest of the industry to demonstrate value to their potential and existing clients. Although what other discount brokerages will do to respond is unknown, one thing is for sure, those pennies investors may still have stashed away just got a lot more valuable.

I am not happy with VB’s service. The have low fees but you get what you pay for. If you want monkeys processing your trades, then VB is the company for you. I enrolled one of my stocks in VB’s DRP program to have the dividends reinvested back in to the stock that the divi originated. To make the request, you can’t just phone up and ask the Cust. Serv. to process this request, nor is there a check box to select this option at the time of purchase. In order to register your stocks in their DRP program, you have to send them an email through their Portal on their website. Once the email is sent, you get nothing confirming whether your request is being processed or whether it’s even been received. You just wait and hope that the next time dividends are paid out, they get reinvested.

In my case, the dividends were not reinvested and I had to call VB to find out why. It’s been a month and a half since the dividends were paid out, VBs admit that they screwed up and that they will fix the problem, but I have yet to see the transaction to fix my problem. They lie to me on the phone, telling me that the transaction will be done today but when I check in the morning to see if they processed the transaction, nothing. I have to phone back and ask again. This has been going on for a month and a half. MONKEYS.

Terrible service. This is a simple request. It should be dealt with in an efficient and timely manner.

Thanks for your comment. Sounds like an unfortunate experience to go through – hopefully it gets resolved quickly and doesn’t happen again. Looking across the comments on other brokerages (big and small) there are also examples of frustrating situations that individual investors find themselves in, including getting dividend payments handled correctly. The common thread amongst them seems to be a bit of persistence to ensure things get addressed. Best of luck getting things back on track!